Economic Factors

Economic conditions play a crucial role in shaping the lab grown diamond jewelry Market. As disposable incomes rise in various regions, consumers are more inclined to invest in luxury items, including lab grown diamond jewelry. The affordability of lab grown diamonds compared to mined diamonds makes them an attractive option for consumers looking to indulge in luxury without the associated high costs. Additionally, economic stability encourages spending on non-essential items, further propelling the market. Data suggests that as economic indicators improve, the demand for lab grown diamonds is likely to increase, reflecting a broader trend towards luxury consumption.

Customization Trends

The desire for personalized jewelry is emerging as a significant driver in the Lab Grown Diamond Jewelry Market. Consumers increasingly seek unique pieces that reflect their individual styles and stories. Lab grown diamonds offer the flexibility for customization, allowing consumers to design their own jewelry with specific shapes, sizes, and settings. This trend is particularly appealing to millennials and Gen Z, who value self-expression and individuality. Market analysis indicates that the customization segment is expected to grow, as retailers adapt to meet the demands of consumers looking for bespoke jewelry experiences.

Sustainability Awareness

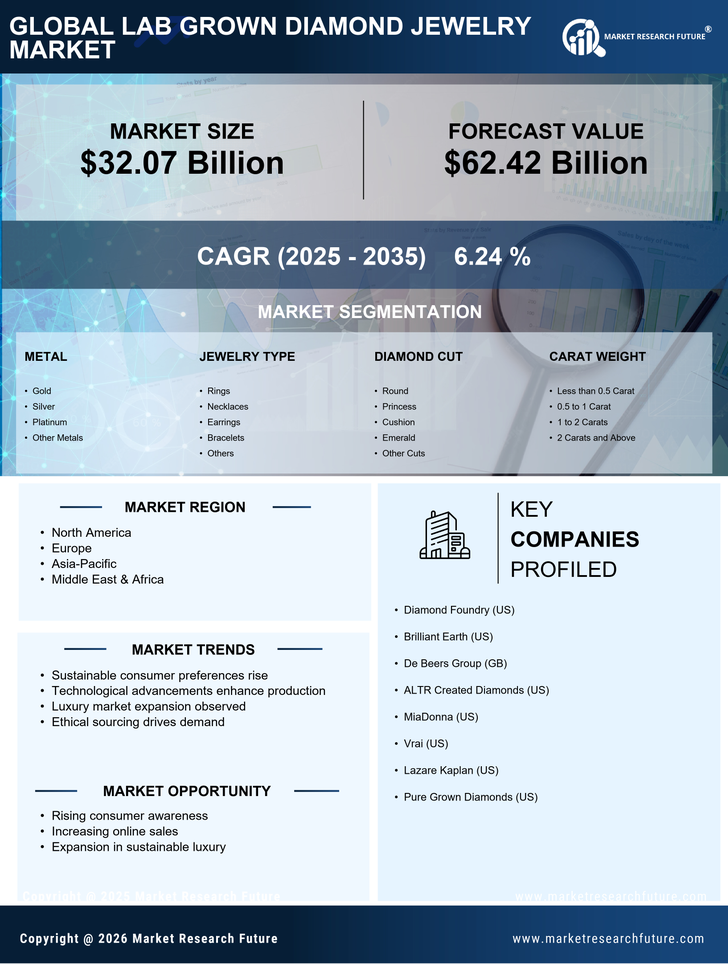

The increasing awareness regarding environmental sustainability appears to be a pivotal driver for the Lab Grown Diamond Jewelry Market. Consumers are becoming more conscious of the ecological impact of traditional diamond mining, which often leads to habitat destruction and carbon emissions. Lab grown diamonds, being created in controlled environments, offer a more sustainable alternative. Reports indicate that the market for lab grown diamonds is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 20% in the coming years. This shift towards eco-friendly options is likely to attract a broader consumer base, particularly among younger generations who prioritize sustainability in their purchasing decisions.

Technological Innovations

Technological advancements in the production of lab grown diamonds are transforming the Lab Grown Diamond Jewelry Market. Innovations such as Chemical Vapor Deposition (CVD) and High Pressure High Temperature (HPHT) methods have enhanced the quality and affordability of lab grown diamonds. These technologies enable the creation of diamonds that are virtually indistinguishable from their mined counterparts. As production costs decrease, the accessibility of lab grown diamonds increases, potentially leading to a surge in consumer interest. Market data suggests that the price of lab grown diamonds has dropped significantly, making them an attractive option for budget-conscious consumers without compromising on quality.

Changing Consumer Preferences

Shifts in consumer preferences are driving the Lab Grown Diamond Jewelry Market towards a more favorable outlook. Many consumers are now prioritizing ethical sourcing and transparency in their purchases. Lab grown diamonds, which are free from the ethical concerns associated with conflict diamonds, resonate with this demand for responsible consumption. Surveys indicate that a substantial percentage of consumers are willing to choose lab grown diamonds over mined ones, primarily due to their ethical implications. This trend is likely to continue, as more consumers seek products that align with their values, thereby expanding the market for lab grown diamond jewelry.