Rising Disposable Income

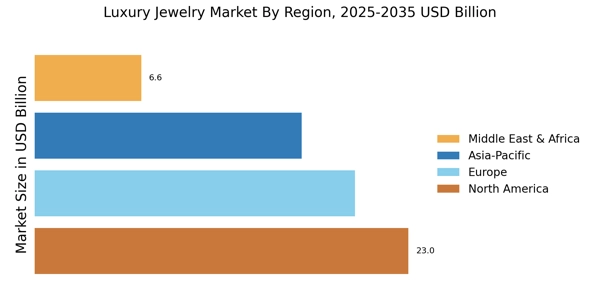

The Luxury Jewelry Market is experiencing a notable increase in demand, driven by rising disposable incomes among affluent consumers. As wealth distribution continues to evolve, a growing segment of the population is able to allocate more funds towards luxury goods, including high-end jewelry. This trend is particularly evident in emerging markets, where economic growth has led to a burgeoning middle class with a penchant for luxury items. According to recent data, the luxury jewelry segment is projected to grow at a compound annual growth rate of approximately 5.5% over the next five years. This increase in purchasing power is likely to bolster the Luxury Jewelry Market, as consumers seek to invest in exquisite pieces that reflect their status and personal style.

Influence of Social Media

The Luxury Jewelry Market is significantly influenced by the rise of social media platforms, which serve as powerful marketing tools for brands. Social media not only facilitates brand visibility but also enables direct engagement with consumers, allowing luxury jewelry brands to showcase their collections in innovative ways. Influencers and celebrities often play a pivotal role in shaping consumer preferences, as their endorsements can lead to increased desirability for specific pieces. Recent statistics indicate that nearly 70% of consumers are influenced by social media when making luxury purchases. This trend suggests that the Luxury Jewelry Market must adapt its marketing strategies to leverage social media effectively, ensuring that brands remain relevant and appealing to a digitally-savvy audience.

Cultural Significance of Jewelry

The Luxury Jewelry Market is deeply intertwined with cultural significance, as jewelry often symbolizes status, tradition, and personal milestones. In various cultures, jewelry plays a crucial role in celebrations, such as weddings and anniversaries, where it is often regarded as a cherished heirloom. This cultural relevance drives demand for luxury pieces that resonate with consumers' identities and values. Furthermore, the increasing globalization of cultures is leading to a fusion of styles, creating new opportunities for luxury jewelry brands to innovate and cater to diverse tastes. As consumers seek unique pieces that reflect their heritage or personal stories, the Luxury Jewelry Market is poised for growth, capitalizing on the emotional connections that jewelry fosters.

Expansion of E-commerce Platforms

The Luxury Jewelry Market is witnessing a transformative shift due to the expansion of e-commerce platforms. As online shopping becomes increasingly prevalent, luxury jewelry brands are investing in digital channels to reach a broader audience. This trend is particularly relevant as consumers seek convenience and accessibility in their shopping experiences. Recent reports suggest that online sales in the luxury sector are expected to account for over 25% of total sales by 2026. This shift towards e-commerce not only allows brands to tap into new markets but also provides opportunities for personalized shopping experiences through advanced technologies. Consequently, the Luxury Jewelry Market is likely to see substantial growth as brands enhance their online presence and engage with consumers in innovative ways.

Growing Demand for Sustainable Practices

The Luxury Jewelry Market is increasingly responding to consumer demand for sustainability and ethical sourcing. As awareness of environmental and social issues rises, consumers are more inclined to support brands that prioritize responsible practices. This shift is prompting luxury jewelry companies to adopt sustainable sourcing methods, such as using recycled materials and ensuring fair labor practices in their supply chains. Data indicates that approximately 60% of luxury consumers are willing to pay a premium for sustainably sourced products. This growing emphasis on sustainability not only enhances brand reputation but also aligns with the values of a new generation of consumers, thereby driving growth within the Luxury Jewelry Market.