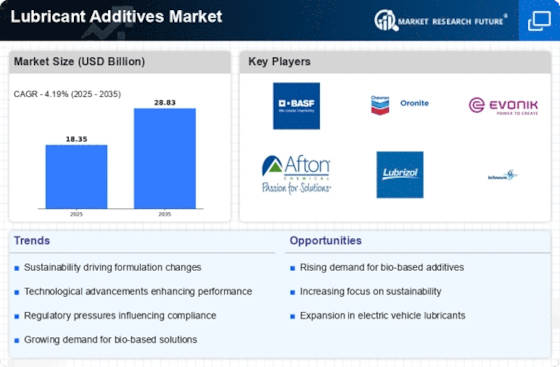

Top Industry Leaders in the Lubricant Additives Market

The lubricant additives market is a key cog in the global machinery of lubrication. These additives enhance the performance and longevity of lubricants, making them crucial for industries like automotive, industrial, and marine. But this seemingly niche market is surprisingly competitive, with established giants and nimble innovators battling for market share. Let's delve into the landscape, exploring strategies, market share factors, industry news, and recent developments.

Strategies Adopted by Market Players:

-

Product Innovation: Companies like Lubrizol and Infineum invest heavily in R&D, developing cutting-edge additives for specific applications and environmental regulations. This includes bio-based and biodegradable options, catering to growing sustainability concerns. -

Vertical Integration: Integrating backwards into base oil production gives players like Chevron Oronite and ExxonMobil greater control over the supply chain and cost efficiency. -

Geographical Diversification: With Asia-Pacific driving growth, established players like Afton Chemical are focusing on expanding their presence in these regions through acquisitions and partnerships. -

Partnerships and Collaborations: Collaborations with automakers and lubricant manufacturers help companies tailor additives to specific requirements, gain market access, and share expertise.

Factors Influencing Market Share:

-

Brand Reputation: Established brands like Lubrizol and Infineum command premium prices due to their proven track record and technological prowess. -

Product Portfolio Breadth: Offering a diverse range of additives for various applications caters to a wider customer base and increases market share. -

Cost Competitiveness: Efficient production and sourcing strategies allow companies like Afton Chemical to offer competitive pricing and attract cost-conscious customers. -

Regulatory Compliance: Adapting to stringent environmental regulations and developing compliant additives is crucial for long-term success, as evidenced by Chemtura's strong presence in the eco-friendly additives segment.

List of Key Players in the Insulating Glass Market

-

AGC Inc. (Japan),

-

Central Glass Co., Ltd. (Japan),

-

Compagnie de Saint-Gobain SA (France),

-

Dymax (US),

-

Glaston Corporation (Finland),

-

Guardian Glass (US),

-

H.B. Fuller Company (US),

-

Henkel AG & Co.

-

KGaA (Germany),

-

Internorm (Austria),

-

Scheuten (Netherlands),

-

Nippon Sheet Glass Co., Ltd. (Japan),

-

Sika AG (Switzerland),

-

3M (US),

-

Viracon (US)

Recent Developments:

October 13, 2021: - To meet growing demand from customers in various applications like PVB plasticizers for safety glass production in construction and automotive segments or synthetic lubricants for the white goods industry etc., BPC will add another thirty thousand metric tons annually so that it could produce up to six hundred thousand metric tons per annum. This expansion will meet the growing demand of people in various 2-EHA downstream applications, such as synthetic lubricants for the white goods industry and PVB plasticizers for safety glass production in the construction and automotive segments.

Infineum expanded its single oil category II solutions for MA N B& W two-stroke engines in June 2021.

February 22, 2021: Dover Chemical introduced DOVERLUBE 31700 a polymeric ester additive for the metalworking industry, improving lubricity together with lubricant oils. This is a nonstaining, oil-soluble and proprietary polymer ester for metalworking fluids and lubricant applications. Moreover, it imparts lubricity and can be used as an enhancement or substitute for EP additives in formulations.

September 8, 2020: On this day, Chevron Oronite Brasil Ltda., a wholly owned subsidiaries of Chevron Corporation, announced that quantiQ Distribuidora Ltda. Will become their distributor in Brazil. Not only does the agreement cover OLOA®lubricant additives, OGA®gasoline additives and PARATONE® Viscosity Modifiers (VM), but in addition, quanitQ will also distribute Oronite chemicals which encompass an extensive product line of raw materials, intermediates and components.