Culinary Trends and Innovation

Culinary trends are significantly influencing the Maple Syrup Market, as chefs and home cooks alike explore innovative uses for maple syrup beyond traditional applications. The versatility of maple syrup as a flavor enhancer in both sweet and savory dishes is gaining traction, leading to increased experimentation in recipes. Recent surveys indicate that approximately 40% of consumers are incorporating maple syrup into their cooking, which has contributed to a rise in demand for diverse maple syrup products. This trend is likely to encourage producers to innovate and diversify their offerings, potentially leading to the introduction of new flavors and blends. As culinary creativity continues to flourish, the Maple Syrup Market may experience sustained growth driven by evolving consumer tastes and preferences.

Health Benefits of Maple Syrup

The Maple Syrup Market is experiencing a surge in demand due to the increasing awareness of health benefits associated with maple syrup. Rich in antioxidants and minerals, maple syrup is perceived as a healthier alternative to refined sugars. Recent data indicates that consumers are gravitating towards natural sweeteners, with maple syrup sales witnessing a notable increase of approximately 20% over the past year. This trend is particularly pronounced among health-conscious individuals who prioritize organic and natural products. As a result, the Maple Syrup Market is likely to continue expanding, driven by the growing consumer preference for products that align with healthier lifestyles. Furthermore, the promotion of maple syrup as a source of essential nutrients may further bolster its appeal, potentially leading to increased market penetration in various food and beverage applications.

Sustainability and Ethical Sourcing

Sustainability initiatives are becoming increasingly pivotal within the Maple Syrup Market. Consumers are now more inclined to support brands that prioritize ethical sourcing and environmentally friendly practices. The demand for sustainably produced maple syrup has led to a rise in certifications and labeling that emphasize eco-friendly production methods. Recent statistics suggest that approximately 30% of consumers are willing to pay a premium for sustainably sourced products. This shift not only enhances brand loyalty but also encourages producers to adopt sustainable practices, thereby positively impacting the overall market. As the Maple Syrup Market evolves, the emphasis on sustainability is likely to shape consumer preferences and purchasing decisions, fostering a more responsible and environmentally conscious market landscape.

E-Commerce Growth and Digital Marketing

The Maple Syrup Market is witnessing a transformative shift due to the rapid growth of e-commerce and digital marketing strategies. With the increasing reliance on online shopping, many producers are expanding their digital presence to reach a broader audience. Recent data indicates that online sales of maple syrup have surged by over 25% in the past year, reflecting changing consumer behaviors. This trend is particularly beneficial for small-scale producers who can leverage e-commerce platforms to compete with larger brands. Additionally, effective digital marketing campaigns are enhancing brand visibility and consumer engagement, further driving sales. As the Maple Syrup Market adapts to these changes, the integration of technology and online sales channels is likely to play a crucial role in shaping its future trajectory.

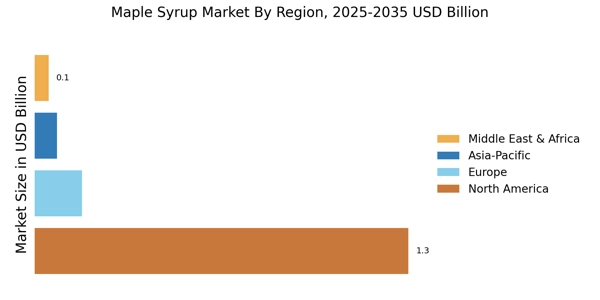

Export Opportunities and International Markets

The Maple Syrup Market is poised for growth through expanding export opportunities and tapping into international markets. Countries with a strong tradition of maple syrup production, such as Canada and the United States, are increasingly looking to export their products to regions with rising demand for natural sweeteners. Recent trade data suggests that exports of maple syrup have increased by approximately 15% in the last year, indicating a growing interest in international markets. This trend is particularly evident in regions where consumers are becoming more health-conscious and seeking alternatives to artificial sweeteners. As the Maple Syrup Market capitalizes on these opportunities, it may witness enhanced growth prospects, driven by the globalization of food preferences and the increasing popularity of maple syrup as a premium product.