Glucose Syrup Market Summary

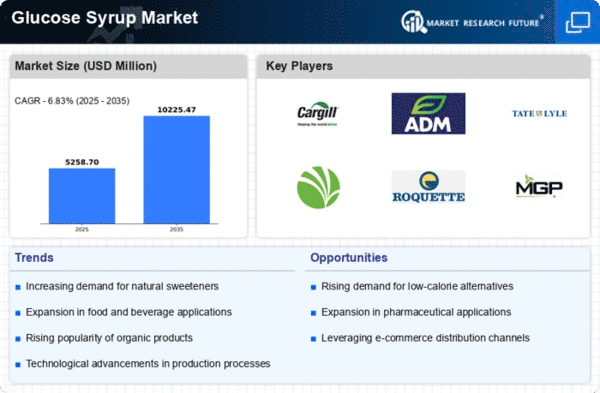

As per MRFR analysis, the Glucose Syrup Market Size was estimated at 4922.49 USD Million in 2024. The glucose syrup industry is projected to grow from 5315.1 USD Million in 2025 to 10225.47 USD Million by 2035, exhibiting a compound annual growth rate (CAGR) of 6.83% during the forecast period 2025 - 2035.

Key Market Trends & Highlights

The glucose syrup market is experiencing a dynamic shift towards natural and clean label products, driven by evolving consumer preferences.

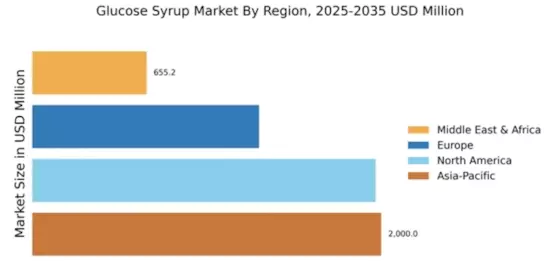

- The North American region remains the largest market for glucose syrup, reflecting robust demand in the food and beverage sector.

- Asia-Pacific is identified as the fastest-growing region, propelled by increasing urbanization and changing dietary habits.

- The food industry continues to dominate glucose syrup consumption, while the beverage industry is emerging as the fastest-growing segment.

- Key market drivers include the rising demand in the food and beverage sector and the expansion of health and wellness products.

Market Size & Forecast

| 2024 Market Size | 4922.49 (USD Million) |

| 2035 Market Size | 10225.47 (USD Million) |

| CAGR (2025 - 2035) | 6.83% |

Major Players

Cargill (US), Archer Daniels Midland (US), Tate & Lyle (GB), Ingredion (US), Roquette Freres (FR), MGP Ingredients (US), Grain Processing Corporation (US), Kraft Heinz (US), Südzucker AG (DE)