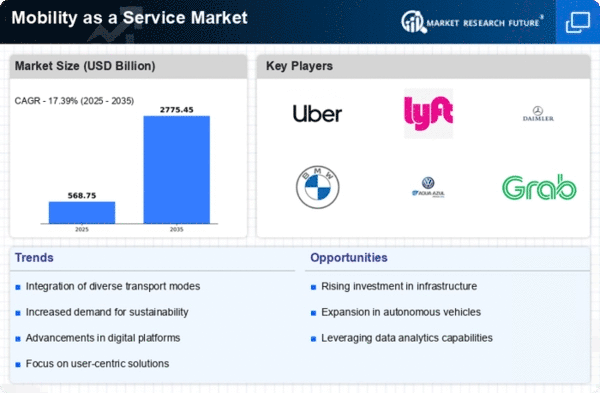

The Mobility as a Service Market is currently characterized by a dynamic competitive landscape, driven by technological advancements, evolving consumer preferences, and a growing emphasis on sustainability. The adoption of smart mobility solutions for the transportation industry is driving innovation and competition. The global mobility market is undergoing rapid transformation with the rise of integrated digital platforms. Major players are strengthening their positions in the evolving mobility market through partnerships and innovation. Major players such as Uber Technologies Inc (US), Daimler AG (DE), and Grab Holdings Inc (SG) are strategically positioning themselves through innovation and partnerships. Uber Technologies Inc (US) continues to enhance its platform by integrating electric vehicles (EVs) and autonomous driving technologies, thereby appealing to environmentally conscious consumers. Meanwhile, Daimler AG (DE) focuses on expanding its mobility solutions through strategic alliances with local transport providers, which enhances its service offerings and market reach. Collectively, these strategies contribute to a competitive environment that is increasingly focused on technological integration and customer-centric solutions. The business tactics employed by these companies reflect a moderately fragmented market structure, where localized strategies and supply chain optimization play crucial roles. Companies are increasingly localizing their services to cater to regional demands, which not only enhances customer satisfaction but also fosters loyalty. The collective influence of these key players is significant, as they navigate regulatory challenges and adapt to the evolving landscape of urban mobility. In November 2025, Uber Technologies Inc (US) announced a partnership with a leading electric vehicle manufacturer to introduce a fleet of electric rideshare vehicles in major metropolitan areas. This strategic move is likely to bolster Uber's commitment to sustainability while potentially reducing operational costs associated with fuel. The integration of electric vehicles into its fleet may also enhance its brand image, appealing to a growing segment of eco-conscious consumers. In October 2025, Daimler AG (DE) launched a new mobility platform that integrates various transportation modes, including public transit, ride-hailing, and bike-sharing, into a single app. This initiative is indicative of Daimler's focus on providing seamless mobility solutions, which could significantly improve user experience and operational efficiency. By consolidating multiple services, Daimler positions itself as a comprehensive mobility provider, potentially attracting a broader customer base. In September 2025, Grab Holdings Inc (SG) expanded its services to include a subscription model for frequent users, offering discounted rides and exclusive promotions. This strategic initiative appears to be a response to increasing competition in the region, aiming to enhance customer retention and loyalty. By providing value-added services, Grab may strengthen its market position and mitigate the impact of price wars prevalent in the industry. As of December 2025, the Mobility as a Service Market is witnessing trends that emphasize digitalization, sustainability, and the integration of artificial intelligence. Strategic alliances among key players are shaping the competitive landscape, fostering innovation and enhancing service delivery. The shift from price-based competition to a focus on technological advancements and supply chain reliability is becoming increasingly evident. Companies that prioritize innovation and adaptability are likely to differentiate themselves in this evolving market, suggesting a future where competitive advantage hinges on the ability to leverage technology and respond to consumer needs.