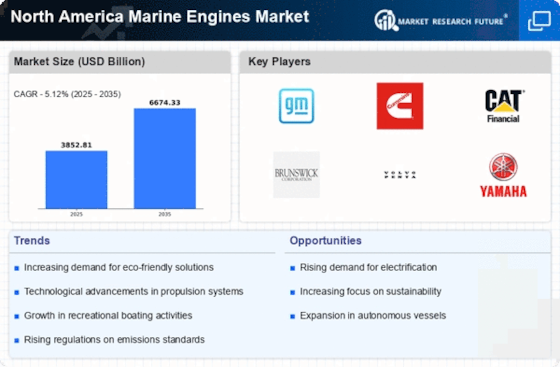

Investment in Marine Infrastructure

Investment in marine infrastructure is a crucial driver for the North America Marine Engine Market. Governments and private entities are increasingly allocating funds to upgrade and expand port facilities, shipyards, and related infrastructure. This investment not only enhances the efficiency of marine operations but also stimulates demand for new marine engines. Improved infrastructure facilitates the movement of goods and passengers, thereby increasing the need for reliable and advanced marine engines. Additionally, the focus on modernizing existing facilities to accommodate larger vessels further propels the market. As infrastructure development continues, it is anticipated that the North America Marine Engine Market will experience sustained growth, driven by the need for innovative engine solutions.

Rising Demand for Recreational Boating

The North America Marine Engine Market is significantly benefiting from the rising demand for recreational boating. As more individuals seek leisure activities on water, the market for personal watercraft and recreational boats is expanding. This trend is supported by a growing interest in outdoor activities and an increase in disposable income among consumers. According to industry reports, the recreational boating sector is projected to grow steadily, leading to a higher demand for marine engines that power these vessels. Manufacturers are responding by offering a diverse range of engines designed for various types of recreational boats, thereby enhancing their market presence. This growing segment is expected to be a key driver for the North America Marine Engine Market.

Growth in Commercial Shipping and Trade

The North America Marine Engine Market is experiencing a notable surge due to the growth in commercial shipping and trade activities. The region's strategic location and extensive coastline facilitate significant maritime trade, which in turn drives the demand for marine engines. According to recent data, the volume of goods transported by sea is projected to increase, leading to a higher requirement for efficient and reliable marine engines. This trend is further supported by the expansion of ports and shipping facilities, which enhances logistical capabilities. Consequently, manufacturers are focusing on producing high-performance engines tailored for commercial vessels, thereby contributing to the overall growth of the North America Marine Engine Market.

Technological Innovations in Marine Engineering

Technological innovations are playing a pivotal role in shaping the North America Marine Engine Market. Advancements in engine design, materials, and digital technologies are enabling manufacturers to produce more efficient and powerful marine engines. For example, the integration of smart technologies, such as IoT and AI, allows for real-time monitoring and predictive maintenance, enhancing operational efficiency. Furthermore, the development of hybrid and electric marine engines is gaining traction, reflecting a shift towards sustainable practices. These innovations not only improve performance but also reduce operational costs for vessel operators. As a result, the North America Marine Engine Market is likely to witness increased investment in research and development to stay competitive in this rapidly evolving landscape.

Regulatory Compliance and Environmental Standards

The North America Marine Engine Market is increasingly influenced by stringent regulatory compliance and environmental standards. Governments in the region are implementing policies aimed at reducing emissions and promoting cleaner technologies. For instance, the Environmental Protection Agency (EPA) has established regulations that require marine engines to meet specific emission limits. This has led to a growing demand for advanced marine engines that comply with these standards. As a result, manufacturers are investing in research and development to create engines that not only meet regulatory requirements but also enhance fuel efficiency. The shift towards environmentally friendly solutions is expected to drive growth in the North America Marine Engine Market, as stakeholders seek to align with sustainability goals.