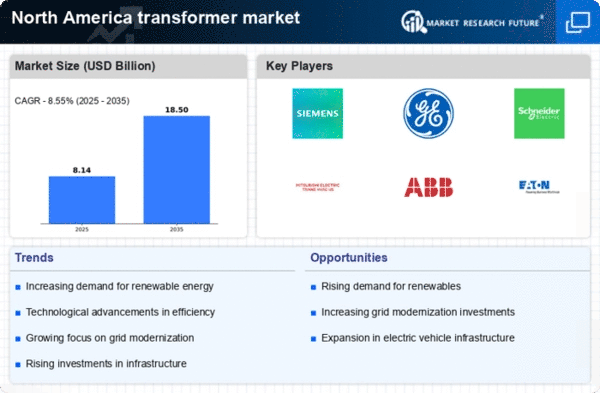

Rising Demand for Renewable Energy

The increasing emphasis on renewable energy sources in North America is driving the transformer market. As states and provinces set ambitious targets for renewable energy generation, the need for efficient transformers to integrate these sources into the grid becomes paramount. For instance, the U.S. Energy Information Administration projects that renewable energy will account for over 50% of electricity generation by 2030. This shift necessitates advanced transformer technologies that can handle variable loads and improve grid reliability. Consequently, manufacturers are focusing on developing transformers that are compatible with solar and wind energy systems, thereby enhancing their market presence in the transformer market.

Investment in Smart Grid Technologies

The transition towards smart grid technologies is significantly influencing the transformer market in North America. Utilities are investing heavily in smart grid infrastructure to enhance efficiency, reliability, and security. According to the U.S. Department of Energy, investments in smart grid technologies are expected to exceed $100 billion by 2030. This investment includes the deployment of smart transformers that can monitor and manage energy flow in real-time. Such advancements not only improve operational efficiency but also facilitate the integration of distributed energy resources, thereby creating a robust demand for innovative transformer solutions in the market.

Regulatory Support for Energy Transition

Regulatory frameworks in North America are increasingly supportive of energy transition initiatives, which is beneficial for the transformer market. Policies aimed at reducing carbon emissions and promoting energy efficiency are prompting utilities to invest in advanced transformer technologies. For example, the Clean Power Plan and various state-level regulations encourage the adoption of low-emission technologies, including transformers that support renewable energy integration. This regulatory environment not only fosters innovation but also drives demand for transformers that comply with stringent efficiency standards, thereby enhancing the overall market landscape.

Aging Infrastructure and Replacement Needs

The aging electrical infrastructure in North America presents a critical driver for the transformer market. Many transformers currently in operation are nearing the end of their operational lifespan, necessitating replacement and upgrades. The U.S. Department of Energy estimates that approximately 70% of transformers in the U.S. are over 25 years old. This situation creates a substantial opportunity for manufacturers to supply modern, efficient transformers that meet contemporary standards. As utilities prioritize infrastructure upgrades to enhance reliability and reduce outages, the demand for new transformers is likely to surge, thereby positively impacting the transformer market.

Technological Advancements in Transformer Design

Technological advancements in transformer design are reshaping the transformer market in North America. Innovations such as improved insulation materials, enhanced cooling systems, and digital monitoring capabilities are leading to the development of more efficient and reliable transformers. These advancements are crucial as they allow transformers to operate at higher capacities while minimizing energy losses. The market is witnessing a shift towards compact and lightweight designs that facilitate easier installation and maintenance. As manufacturers continue to invest in research and development, the introduction of cutting-edge transformer technologies is expected to drive growth in the transformer market.