Increasing Energy Demand

The Oil Pipeline Infrastructure Market is experiencing a surge in demand for energy, driven by population growth and industrialization. As economies expand, the need for efficient transportation of crude oil and refined products becomes paramount. According to recent data, global energy consumption is projected to rise by approximately 30% by 2040, necessitating the expansion and modernization of pipeline networks. This trend indicates that investments in oil pipeline infrastructure are likely to increase, as companies seek to enhance their capacity to meet rising energy needs. Furthermore, the shift towards cleaner energy sources may also influence the design and operation of pipelines, integrating more sustainable practices into the Oil Pipeline Infrastructure Market.

Technological Innovations

Technological advancements are reshaping the Oil Pipeline Infrastructure Market, enhancing efficiency and safety in pipeline operations. Innovations such as smart pipeline monitoring systems, advanced materials, and automation technologies are being adopted to optimize performance. For example, the integration of Internet of Things (IoT) devices allows for real-time monitoring of pipeline conditions, enabling proactive maintenance and reducing the risk of leaks. The market for pipeline monitoring technologies is expected to grow significantly, with estimates suggesting a compound annual growth rate of over 10% in the coming years. These technological innovations not only improve operational efficiency but also contribute to the overall sustainability of the Oil Pipeline Infrastructure Market.

Regulatory Frameworks and Compliance

The Oil Pipeline Infrastructure Market is significantly influenced by evolving regulatory frameworks aimed at ensuring safety and environmental protection. Governments are increasingly implementing stringent regulations regarding pipeline construction, operation, and maintenance. Compliance with these regulations often requires substantial investment in infrastructure upgrades and monitoring systems. For instance, the implementation of the Pipeline Safety Improvement Act has led to increased scrutiny of existing pipelines, compelling operators to enhance their safety measures. This regulatory environment not only drives investment in the Oil Pipeline Infrastructure Market but also encourages innovation in technology and practices to meet compliance standards, thereby shaping the future landscape of the industry.

Investment in Infrastructure Development

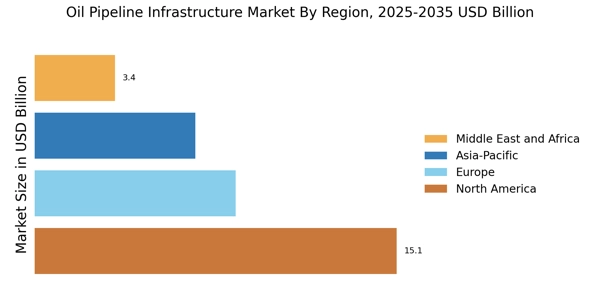

Investment in infrastructure development is a critical driver for the Oil Pipeline Infrastructure Market. As countries seek to enhance their energy security and reduce dependence on imports, there is a growing emphasis on developing domestic pipeline networks. Recent reports indicate that investments in pipeline infrastructure are projected to reach several billion dollars annually, reflecting the strategic importance of oil transportation. This influx of capital is likely to facilitate the construction of new pipelines and the expansion of existing ones, thereby increasing the overall capacity of the Oil Pipeline Infrastructure Market. Additionally, public-private partnerships are emerging as a viable model for financing these projects, further stimulating growth in the sector.

Geopolitical Factors and Supply Chain Dynamics

Geopolitical factors play a pivotal role in shaping the Oil Pipeline Infrastructure Market. Political stability, trade agreements, and international relations can significantly impact the flow of oil and the development of pipeline projects. For instance, tensions in oil-rich regions often lead to disruptions in supply chains, prompting countries to invest in alternative routes and infrastructure. The recent focus on energy independence has led to increased investments in domestic pipeline projects, as nations seek to secure their energy supplies. This geopolitical landscape not only influences the strategic planning of pipeline infrastructure but also drives innovation and adaptation within the Oil Pipeline Infrastructure Market, as stakeholders navigate the complexities of global energy dynamics.