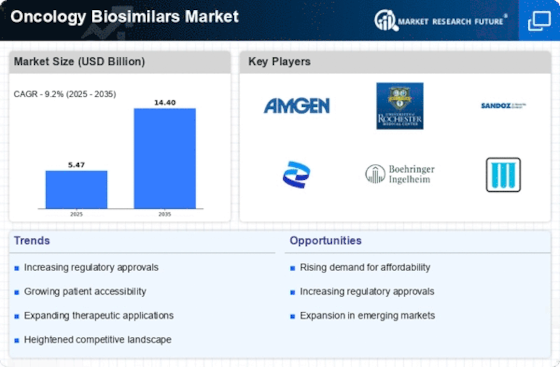

Cost Containment Pressures

Cost containment pressures within healthcare systems are driving the growth of the Oncology Biosimilars Market. As healthcare costs continue to rise, payers and providers are increasingly seeking ways to reduce expenditures while maintaining quality care. Biosimilars present a viable solution, as they typically offer lower prices compared to their reference biologics. This price differential is particularly appealing in oncology, where treatment regimens can be prohibitively expensive. The Oncology Biosimilars Market is thus positioned to benefit from these economic pressures, as stakeholders prioritize cost-effective therapies to manage budgets and improve patient access to essential treatments.

Advancements in Biotechnology

Technological advancements in biotechnology are transforming the landscape of the Oncology Biosimilars Market. Innovations in biomanufacturing processes and analytical techniques have enhanced the ability to produce high-quality biosimilars that closely mimic their reference biologics. These advancements not only improve the efficacy and safety profiles of biosimilars but also streamline the regulatory approval process. As a result, the Oncology Biosimilars Market is witnessing an influx of new products, which could potentially lead to increased competition and lower prices for patients. The ongoing research and development efforts in this field suggest a promising future for biosimilars in oncology.

Increasing Incidence of Cancer

The rising incidence of cancer worldwide is a pivotal driver for the Oncology Biosimilars Market. As cancer cases continue to escalate, the demand for effective treatment options intensifies. According to recent statistics, cancer is projected to affect approximately 1 in 5 individuals during their lifetime, leading to a substantial increase in healthcare expenditure. This surge in cancer prevalence necessitates the development and availability of biosimilars, which offer a more affordable alternative to expensive biologic therapies. Consequently, the Oncology Biosimilars Market is likely to experience significant growth as healthcare providers seek cost-effective solutions to manage the increasing patient population.

Regulatory Framework Enhancements

The evolving regulatory framework surrounding biosimilars is a crucial driver for the Oncology Biosimilars Market. Regulatory agencies are increasingly establishing clear guidelines for the approval and monitoring of biosimilars, which fosters confidence among manufacturers and healthcare providers. These enhancements not only expedite the entry of new biosimilars into the market but also ensure that they meet stringent safety and efficacy standards. As a result, the Oncology Biosimilars Market is likely to see a rise in the number of approved products, thereby expanding treatment options for patients and potentially lowering costs through increased competition.

Patient-Centric Treatment Approaches

The shift towards patient-centric treatment approaches is influencing the Oncology Biosimilars Market. As healthcare systems increasingly prioritize personalized medicine, there is a growing recognition of the need for diverse treatment options that cater to individual patient needs. Biosimilars, with their comparable efficacy and safety profiles to reference biologics, are becoming integral to these patient-centric strategies. This trend is expected to enhance the acceptance and utilization of biosimilars among healthcare providers and patients alike. Consequently, the Oncology Biosimilars Market may experience accelerated growth as stakeholders embrace these innovative therapies to improve patient outcomes.