Market Trends

Key Emerging Trends in the Operating Room Equipment Supplies Market

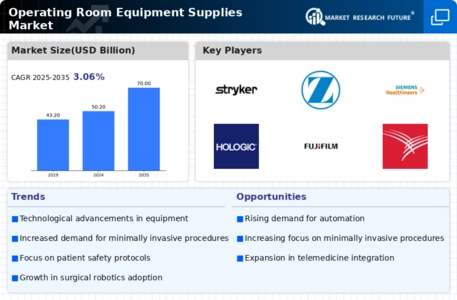

The operating room equipment and supplies market is witnessing several trends reshaping the landscape of surgical settings, driven by technological advancements, changing healthcare demands, and a focus on patient outcomes. One significant trend is the increasing integration of digital and robotic technologies in operating rooms. Surgical robots, advanced imaging systems, and computer-assisted technologies enhance precision, enable minimally invasive procedures, and improve overall surgical outcomes. This trend reflects a continuous push toward innovation and the adoption of cutting-edge technologies to enhance the efficiency and effectiveness of surgical procedures. Another notable trend is the emphasis on infection control and patient safety. Operating rooms are increasingly incorporating advanced sterilization and disinfection technologies to create a sterile environment and reduce the risk of surgical site infections. Enhanced sterilization methods, such as hydrogen peroxide vapor systems and ultraviolet-C (UV-C) light disinfection, are gaining prominence. This trend aligns with a growing awareness of the importance of infection prevention measures in healthcare settings, contributing to improved patient care and recovery. The shift towards minimally invasive surgeries influences the demand for specialized equipment and supplies. Minimally invasive procedures offer reduced recovery times, smaller incisions, and lower infection rates. As a result, there is an increased demand for laparoscopic instruments, endoscopic systems, and robotic-assisted surgical devices. This trend reflects a broader movement in healthcare towards less invasive interventions that enhance patient comfort and reduce healthcare costs. The rise of ambulatory surgical centers (ASCs) is impacting the operating room equipment and supplies market. ASCs, which focus on providing same-day surgical procedures, are gaining popularity due to their cost-effectiveness and convenience. This trend drives the need for compact and versatile operating room equipment suitable for these outpatient settings. Manufacturers are adapting their products to meet the specific requirements of ASCs, contributing to the diversification of the market. Integration of data and connectivity solutions within operating room equipment is becoming prevalent. The demand for seamless communication between devices, electronic health records (EHRs), and hospital information systems drives the development of interoperable equipment. Integrated solutions enhance workflow efficiency, facilitate real-time monitoring, and contribute to data-driven decision-making in the operating room. This trend aligns with the broader digitization of healthcare systems and the pursuit of more efficient and connected healthcare environments. Patient-centered care is influencing the design and functionality of operating room equipment. The focus is on creating a patient-friendly environment that promotes comfort and reduces anxiety. This includes innovations such as adjustable operating tables, ergonomic surgical instruments, and improved lighting systems. The trend towards patient-centered care aims to enhance the overall surgical experience for patients and contribute to better post-operative outcomes. Sustainability is emerging as a consideration in the operating room equipment and supplies market. Healthcare facilities are exploring eco-friendly practices, including recyclable materials, energy-efficient technologies, and waste reduction strategies. This trend reflects a broader societal shift towards sustainability and environmental responsibility, with healthcare providers recognizing the importance of reducing their ecological footprint. Personal protective equipment (PPE) has gained heightened importance, driven by global events such as the COVID-19 pandemic. The need for enhanced infection control measures has led to increased demand for high-quality surgical masks, gowns, and face shields. This trend underscores PPE's critical role in ensuring healthcare professionals' safety and preventing the spread of infectious diseases within operating rooms. Telemedicine and remote collaboration influence the operating room equipment market, especially in surgical education and training. Virtual reality (VR) and augmented reality (AR) technologies are being integrated into surgical training programs, allowing surgeons to practice and refine their skills in a simulated environment. This trend supports the ongoing evolution of medical education, enabling more immersive and accessible training experiences. The market is witnessing a trend towards standardizing operating room equipment and supplies. Healthcare providers seek standardized solutions that streamline procurement processes, improve cost-efficiency, and ensure consistency in patient care. This trend reflects the growing importance of efficiency and cost-effectiveness in healthcare operations, encouraging standardization to optimize resource utilization.

Leave a Comment