Market Analysis

In-depth Analysis of Operating Room Equipment Supplies Market Industry Landscape

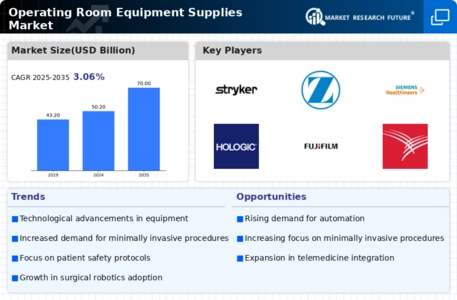

The global operating room equipment supplies market reached USD 43.8 BN in 2022 and is poised to grow to USD 87.56 BN by 2032, registering an 8% CAGR during the review period (2023-2032). The market dynamics encompass a multifaceted interplay of factors that collectively influence the healthcare industry's demand, evolution, and trends. The dynamics are chiefly driven by technological advancements and innovations in medical equipment, shaping the demand for cutting-edge tools and supplies used in surgical procedures. Advancements such as minimally invasive surgical techniques and robotic-assisted surgeries have revolutionized the field, prompting a need for specialized equipment and supplies designed to support these sophisticated procedures. This technological evolution continually pushes the market forward, emphasizing precision, efficiency, and improved patient outcomes. Moreover, the increasing demand for healthcare services and the rise in surgical procedures worldwide significantly impact the market dynamics. Population growth, aging demographics, and the prevalence of chronic diseases contribute to the escalating need for surgical interventions, driving the demand for a wide array of operating room equipment and supplies. Hospitals and healthcare facilities constantly seek to upgrade their surgical tools, monitoring devices, and sterilization equipment to meet the rising demand for high-quality healthcare services. Cost considerations and budget constraints within healthcare systems also influence the operating room equipment supplies market dynamics. Hospitals and healthcare facilities face balancing technological advancements with cost-effective solutions. As a result, there's a continual emphasis on the development of equipment and supplies that offer superior performance while remaining economically viable for healthcare providers. This factor often drives innovation towards cost-efficiency without compromising quality or safety standards. Regulatory standards and compliance play a pivotal role in shaping market dynamics. Strict regulations regarding the safety, efficacy, and quality of medical equipment and supplies impact product development, market-entry, and usage within healthcare settings. Adherence to regulatory requirements and obtaining certifications significantly influence manufacturers' strategies, product features, and market penetration. The market dynamics are also influenced by shifting healthcare delivery models and preferences. Healthcare systems increasingly adopt value-based care models, prioritizing patient outcomes, efficiency, and cost-effectiveness. This trend drives the demand for equipment and supplies that align with these models, focusing on innovation to enhance patient care, reduce recovery times, and improve healthcare efficiency. Competitive strategies and industry consolidation significantly impact the market landscape. Companies within the operating room equipment and supplies sector engage in mergers, acquisitions, and collaborations to expand their product portfolios, enhance market presence, and leverage synergies. This competition drives continuous innovation, pricing strategies, and improvements in service offerings to maintain a competitive edge in the market. Global trends in healthcare infrastructure and technological adoption significantly influence market dynamics. Emerging markets, particularly in Asia and Latin America, exhibit rapid growth in healthcare infrastructure, creating substantial demand for operating room equipment and supplies. Moreover, the increasing adoption of telemedicine, remote monitoring, and digital healthcare solutions impact the equipment and supplies required to support these evolving healthcare practices.

Leave a Comment