Increased Focus on Regulatory Compliance

The Operational Analytics Market is experiencing an increased focus on regulatory compliance, which is driving the adoption of analytics solutions. Organizations are required to adhere to various regulations that mandate transparency and accountability in their operations. As a result, operational analytics tools are being utilized to ensure compliance with industry standards and governmental regulations. This trend is particularly evident in sectors such as finance and healthcare, where regulatory scrutiny is intense. Recent data indicates that companies investing in compliance analytics can reduce the risk of non-compliance penalties by up to 40%. Consequently, the Operational Analytics Market is likely to expand as organizations seek to mitigate compliance risks through advanced analytics.

Rising Importance of Predictive Analytics

The Operational Analytics Market is witnessing a rising importance of predictive analytics, which enables organizations to forecast future trends and behaviors based on historical data. This capability is particularly valuable in sectors such as manufacturing, retail, and finance, where anticipating customer needs and operational challenges can lead to significant cost savings and improved service delivery. Recent data suggests that predictive analytics can reduce operational costs by up to 25%, thereby enhancing profitability. As businesses increasingly adopt predictive models, the demand for operational analytics solutions is expected to escalate. This trend indicates a shift towards proactive management strategies, positioning the Operational Analytics Market for continued expansion as organizations seek to harness the power of predictive insights.

Emphasis on Enhanced Operational Efficiency

The Operational Analytics Market is characterized by an emphasis on enhanced operational efficiency. Organizations are increasingly focused on streamlining processes and reducing waste, which necessitates the adoption of advanced analytics solutions. By utilizing operational analytics, companies can identify inefficiencies and optimize resource allocation, leading to improved productivity. Recent studies indicate that businesses implementing operational analytics can achieve efficiency gains of up to 30%. This drive for efficiency is particularly pronounced in sectors such as logistics and supply chain management, where operational costs can significantly impact profitability. As a result, the Operational Analytics Market is likely to see sustained growth as organizations prioritize tools that facilitate operational excellence.

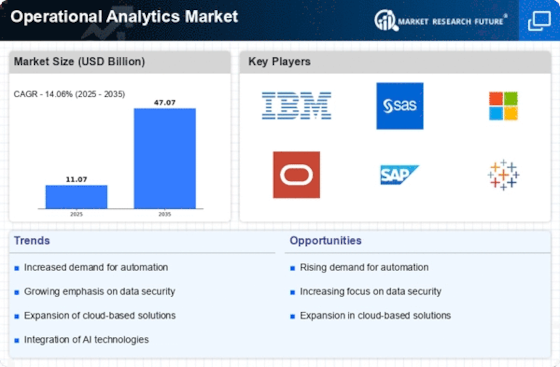

Growing Demand for Data-Driven Decision Making

The Operational Analytics Market is experiencing a notable surge in demand for data-driven decision making. Organizations are increasingly recognizing the value of leveraging data analytics to enhance operational efficiency and drive strategic initiatives. According to recent estimates, the market for operational analytics is projected to reach approximately 20 billion dollars by 2026, reflecting a compound annual growth rate of around 15%. This trend is largely fueled by the need for businesses to remain competitive in a rapidly evolving landscape. As companies strive to optimize their operations, the integration of advanced analytics tools becomes essential. Consequently, the Operational Analytics Market is poised for substantial growth as organizations invest in technologies that facilitate informed decision making.

Integration of Internet of Things (IoT) Technologies

The Operational Analytics Market is increasingly influenced by the integration of Internet of Things (IoT) technologies. The proliferation of connected devices generates vast amounts of data, which can be harnessed for operational analytics. This integration allows organizations to monitor real-time performance metrics and make data-driven adjustments to their operations. For instance, industries such as manufacturing and transportation are leveraging IoT data to enhance predictive maintenance and optimize supply chain processes. The market for IoT-enabled operational analytics is projected to grow significantly, with estimates suggesting a potential increase of over 25% in the next few years. This trend underscores the importance of IoT in shaping the future of the Operational Analytics Market.