Convenience and On-the-Go Options

The demand for convenience in food consumption is reshaping the Organic Packaged Food Market Industry. As lifestyles become busier, consumers are increasingly seeking quick and easy meal solutions that do not compromise on health. Organic packaged foods, which often come in ready-to-eat or easy-to-prepare formats, cater to this need for convenience. Market analysis reveals that products such as organic snacks and meal kits are gaining traction, reflecting a shift towards on-the-go eating habits. This trend suggests that the Organic Packaged Food Market Industry could see continued expansion as manufacturers innovate to provide convenient organic options that appeal to time-strapped consumers.

Health Awareness and Nutritional Benefits

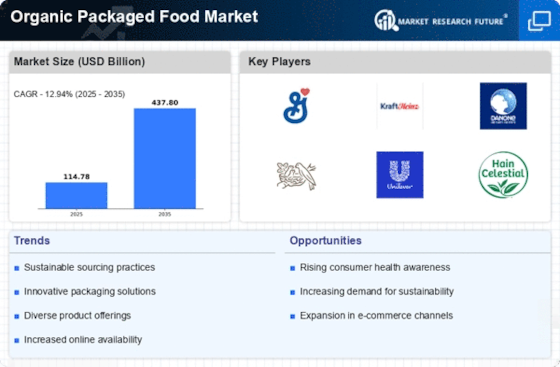

The increasing awareness regarding health and nutrition among consumers appears to be a primary driver for the Organic Packaged Food Market Industry. As individuals become more informed about the adverse effects of processed foods, they are gravitating towards organic options that promise better health outcomes. Reports indicate that the organic food sector has witnessed a compound annual growth rate of approximately 10% over the past few years, suggesting a robust demand for organic packaged foods. This trend is likely to continue as consumers prioritize products that are free from synthetic additives and pesticides, thereby enhancing their overall well-being. The Organic Packaged Food Market Industry is thus positioned to benefit from this heightened focus on health, as more consumers seek to incorporate organic products into their diets.

Sustainability and Environmental Concerns

Sustainability has emerged as a pivotal concern for consumers, influencing their purchasing decisions in the Organic Packaged Food Market Industry. As environmental issues gain prominence, individuals are increasingly opting for products that are sustainably sourced and produced. The organic sector is often perceived as more environmentally friendly, as it typically employs farming practices that reduce pollution and conserve water. Data suggests that a significant portion of consumers is willing to pay a premium for organic products that align with their values regarding sustainability. This trend indicates a potential for growth within the Organic Packaged Food Market Industry, as brands that emphasize eco-friendly practices may attract a loyal customer base committed to environmental stewardship.

Technological Advancements in Food Production

Technological advancements in food production are playing a crucial role in shaping the Organic Packaged Food Market Industry. Innovations in agricultural practices, such as precision farming and biotechnology, are enhancing the efficiency and yield of organic crops. These advancements not only help in meeting the rising demand for organic products but also ensure that they are produced sustainably. Furthermore, improved supply chain technologies are facilitating better distribution of organic packaged foods, making them more accessible to consumers. As these technologies continue to evolve, they may significantly impact the Organic Packaged Food Market Industry, potentially leading to lower prices and increased availability of organic options.

Changing Consumer Preferences and Demographics

Changing consumer preferences and demographics are significantly influencing the Organic Packaged Food Market Industry. Younger generations, particularly millennials and Gen Z, are increasingly prioritizing health, sustainability, and ethical consumption in their purchasing decisions. This demographic shift is driving demand for organic products, as these consumers are more likely to seek out foods that align with their values. Market data indicates that these younger consumers are willing to invest in organic packaged foods, viewing them as a lifestyle choice rather than a mere dietary preference. This evolving consumer landscape suggests that the Organic Packaged Food Market Industry is poised for growth, as brands adapt to meet the expectations of a more health-conscious and environmentally aware customer base.