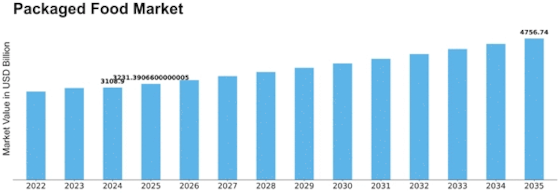

Packaged Food Size

Packaged Food Market Growth Projections and Opportunities

The Packaged Food market is influenced by various key factors that collectively contribute to its dynamics and growth. One significant factor is the changing consumer lifestyles and the increasing demand for convenient, ready-to-eat food options. As individuals lead busier lives, there is a growing reliance on packaged foods that offer convenience and save preparation time. Packaged foods provide an array of choices, ranging from snacks to complete meals, catering to the evolving preferences of consumers seeking quick and hassle-free solutions, which significantly drives the growth of the packaged food market.

Moreover, the impact of urbanization and the rise of dual-income households contribute to the market's expansion. With more people residing in urban areas and participating in the workforce, the demand for convenient and time-saving food options has increased. Packaged foods meet this demand by providing shelf-stable, portable, and easily accessible choices that align with the fast-paced urban lifestyle. The convenience factor positions packaged foods as a practical solution for on-the-go consumers, sustaining the growth of the market.

The influence of technological advancements in food processing and packaging is another crucial factor shaping the packaged food market. Innovations in preservation methods, such as modified atmosphere packaging, extend the shelf life of packaged foods while maintaining freshness. Advanced processing technologies help manufacturers create products with enhanced flavors, textures, and nutritional profiles. These technological developments contribute to the appeal of packaged foods, ensuring they meet the evolving expectations of consumers and remain competitive in the market.

Economic factors, including disposable income and price sensitivity, play a role in shaping the packaged food market. While premium and specialty packaged foods may cater to a niche market, affordability is a crucial consideration for a broader consumer base. Manufacturers often need to balance quality and price to cater to diverse consumer demographics and ensure the widespread accessibility of packaged food products.

Regulatory factors also impact the packaged food market. Adherence to quality standards, nutritional labeling regulations, and food safety guidelines is essential for building consumer trust. Transparent and accurate labeling, including information about ingredients, nutritional content, and allergens, contributes to the credibility of packaged foods in the market. Compliance with health and safety standards is crucial for maintaining the reputation of packaged foods as safe and high-quality options.

The role of marketing strategies is significant in influencing consumer perceptions and market growth. Effective advertising, branding, and promotional activities can enhance the visibility and popularity of packaged food products. Emphasizing factors such as convenience, nutritional benefits, and product variety through various marketing channels can sway consumer preferences and drive market expansion.

Leave a Comment