Rising R&D Expenditure

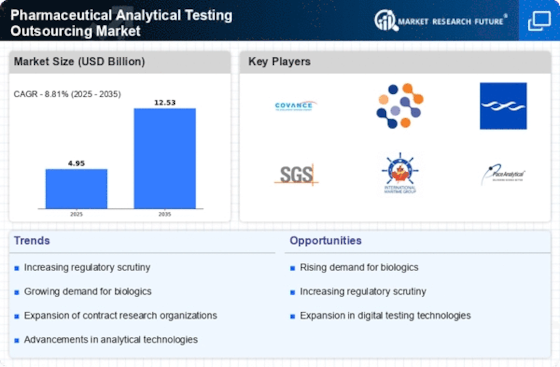

The Pharmaceutical Analytical Testing Outsourcing Market is experiencing a notable increase in research and development expenditure by pharmaceutical companies. As organizations strive to innovate and bring new drugs to market, they allocate substantial budgets towards R&D activities. In 2025, it is estimated that R&D spending in the pharmaceutical sector will reach approximately 200 billion USD, reflecting a growing trend towards outsourcing analytical testing to specialized firms. This shift allows companies to focus on core competencies while leveraging the expertise of outsourcing partners. Consequently, the demand for analytical testing services is likely to surge, as firms seek to ensure compliance with regulatory standards and enhance product quality. The Pharmaceutical Analytical Testing Outsourcing Market is thus positioned to benefit from this upward trajectory in R&D investments.

Stringent Regulatory Requirements

The Pharmaceutical Analytical Testing Outsourcing Market is significantly influenced by the increasing stringency of regulatory requirements imposed by health authorities. Regulatory bodies are continuously updating guidelines to ensure the safety and efficacy of pharmaceutical products. In 2025, it is anticipated that compliance costs for pharmaceutical companies will rise, prompting many to outsource analytical testing to specialized laboratories. This trend is driven by the need for accurate and reliable testing results that meet regulatory standards. Outsourcing not only helps companies navigate complex regulations but also mitigates risks associated with non-compliance. As a result, the demand for analytical testing services is expected to grow, positioning the Pharmaceutical Analytical Testing Outsourcing Market as a critical component in the drug development process.

Technological Advancements in Testing

The Pharmaceutical Analytical Testing Outsourcing Market is witnessing a transformation due to rapid technological advancements in analytical testing methodologies. Innovations such as high-throughput screening, mass spectrometry, and advanced chromatography system techniques are enhancing the efficiency and accuracy of testing processes. In 2025, the market for analytical testing technologies is projected to expand, driven by the need for faster turnaround times and improved data quality. As pharmaceutical companies increasingly adopt these advanced technologies, they are more likely to outsource testing to specialized providers who possess the necessary expertise and equipment. This trend not only streamlines the testing process but also reduces operational costs, thereby fostering growth within the Pharmaceutical Analytical Testing Outsourcing Market.

Cost Efficiency and Resource Optimization

The Pharmaceutical Analytical Testing Outsourcing Market is increasingly driven by the need for cost efficiency and resource optimization among pharmaceutical companies. As the industry faces pressure to reduce operational costs while maintaining high-quality standards, outsourcing analytical testing has emerged as a viable solution. By partnering with specialized testing laboratories, companies can significantly lower their overhead costs associated with maintaining in-house testing facilities. In 2025, it is projected that the outsourcing of analytical testing services will continue to grow, as firms recognize the financial benefits and flexibility it offers. This trend not only allows companies to allocate resources more effectively but also enhances their ability to respond to market demands swiftly. Consequently, the Pharmaceutical Analytical Testing Outsourcing Market is likely to thrive as organizations seek to optimize their operations.

Increasing Complexity of Drug Formulations

The Pharmaceutical Analytical Testing Outsourcing Market is being shaped by the growing complexity of drug formulations, particularly in the development of biologics and personalized medicine. As pharmaceutical companies explore novel therapeutic approaches, the analytical testing requirements become more intricate. In 2025, the market is expected to see a rise in demand for specialized analytical services that can address these complexities. Outsourcing analytical testing allows companies to access specialized knowledge and resources that may not be available in-house. This trend is likely to drive growth in the Pharmaceutical Analytical Testing Outsourcing Market, as firms seek to ensure that their products meet the rigorous testing standards necessary for regulatory approval.