Increasing Energy Demand

The Pipeline Construction Market is experiencing a surge in demand driven by the increasing global energy requirements. As economies expand, the need for efficient transportation of oil and gas becomes paramount. According to recent data, energy consumption is projected to rise by approximately 30% by 2040, necessitating the construction of new pipelines to facilitate this growth. This trend is particularly evident in emerging markets, where industrialization and urbanization are accelerating. Consequently, the Pipeline Construction Market is likely to see substantial investments aimed at enhancing infrastructure to meet these energy demands.

Technological Innovations

Technological advancements are reshaping the Pipeline Construction Market, leading to enhanced efficiency and reduced costs. Innovations such as automated welding, advanced materials, and real-time monitoring systems are becoming increasingly prevalent. These technologies not only improve the safety and reliability of pipelines but also streamline construction processes. For example, the adoption of smart pipeline technologies is expected to reduce operational costs by up to 20%. As these technologies continue to evolve, they are likely to play a crucial role in the Pipeline Construction Market, enabling companies to meet the growing demand for energy infrastructure.

Regulatory Frameworks and Policies

The Pipeline Construction Market is significantly influenced by evolving regulatory frameworks and policies aimed at ensuring safety and environmental protection. Governments are increasingly implementing stringent regulations that govern pipeline construction, operation, and maintenance. These regulations often require advanced technologies and practices, which can drive up construction costs but also enhance safety and efficiency. For instance, the implementation of the Pipeline Safety Improvement Act has led to increased scrutiny and investment in pipeline integrity management. As a result, the Pipeline Construction Market is adapting to these regulatory changes, which may create opportunities for innovation and growth.

Environmental Sustainability Initiatives

The Pipeline Construction Market is increasingly aligning with environmental sustainability initiatives as stakeholders prioritize eco-friendly practices. Companies are adopting greener technologies and methods to minimize the environmental impact of pipeline construction. This shift is partly driven by public demand for sustainable energy solutions and regulatory pressures. For instance, the implementation of carbon capture technologies in pipeline projects is gaining traction. As a result, the Pipeline Construction Market is likely to see a rise in projects that not only focus on efficiency but also on reducing carbon footprints, thereby contributing to a more sustainable energy future.

Investment in Infrastructure Development

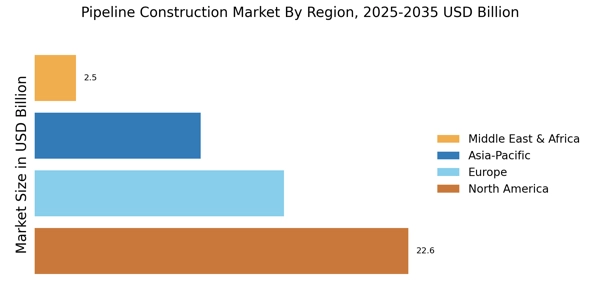

The Pipeline Construction Market is benefiting from increased investment in infrastructure development across various regions. Governments and private entities are recognizing the need for modernized energy infrastructure to support economic growth. In recent years, investments in pipeline projects have surged, with estimates suggesting that spending on pipeline construction could reach over 100 billion dollars annually by 2027. This influx of capital is expected to drive the Pipeline Construction Market forward, facilitating the construction of new pipelines and the expansion of existing networks to meet future energy demands.

Leave a Comment