Market Analysis

In-depth Analysis of Recycled Carbon Fiber Market Industry Landscape

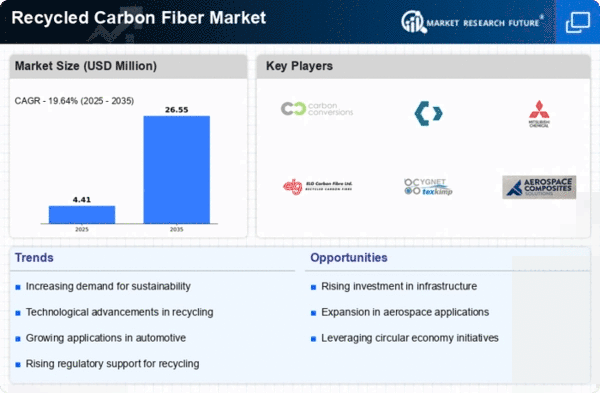

In 2020, the global automotive production experienced a significant decline of around 16%, marking the second consecutive year of decrease. Despite this downturn, there is optimism for a positive turnaround in the automotive industry in the coming years, driven by economic improvements that are expected to fuel market growth. An interesting development in the automotive sector is the collaboration between manufacturers and research institutes to integrate recycled carbon fiber into automobile parts. One example is the partnership between ProDrive Composites, a producer of advanced lightweight composites, and the University of Sheffield Advanced Manufacturing Research Centre (AMRC) in the UK, along with ELG Carbon Fibre. Together, they are working on the P2T (Primary to Tertiary) process, utilizing a reactive thermoplastic resin to manufacture recyclable composite components. Additionally, the emergence of electric vehicles, autonomous vehicles, and increased connectivity features in automobiles is creating new opportunities for components and applications within the industry. Beyond the automotive sector, the aerospace and defense industry is also playing a crucial role in driving the demand for recycled carbon fiber. The need for lightweight materials in this industry is escalating, supported by the growing aviation sector. The demand for airplanes is increasing due to steady economic growth and a rising middle-class population, particularly in the Asia-Pacific region. According to the 2021 Boeing Services Market Outlook report, the global demand for 19,000 commercial airplanes is projected, valued at USD 3.2 trillion over a decade. The established presence of the aerospace and defense industry in developed countries further contributes to the growth of the global recycled carbon fiber market. Recycled carbon fiber is gaining traction across various industries, including automotive, wind energy, industrial goods, and electronics. This surge in demand can be attributed to its advantageous characteristics such as cost-effectiveness, energy efficiency, lightweight nature, and environmental sustainability. Notably, recycled carbon fiber exhibits properties comparable to virgin carbon fiber, including high tensile strength, chemical resistance, low thermal expansion, and being lightweight. Moreover, the production of recycled carbon fiber requires only one-tenth of the energy needed for original carbon fiber production, making it a more environmentally friendly option. In terms of cost, recycled carbon fiber is approximately 20–40% more cost-effective than virgin carbon fiber. These factors position recycled carbon fiber as a strong and commercially viable reinforced fiber, finding applications across a wide range of industries. As industries increasingly prioritize high-performance and cost-efficient materials, the global recycled carbon fiber market is anticipated to experience growth during the forecast period. The combination of economic recovery, technological advancements, and the sustainability benefits of recycled carbon fiber positions it as a key player in the evolving landscape of material usage across industries.

Leave a Comment