Market Share

Recycled Carbon Fiber Market Share Analysis

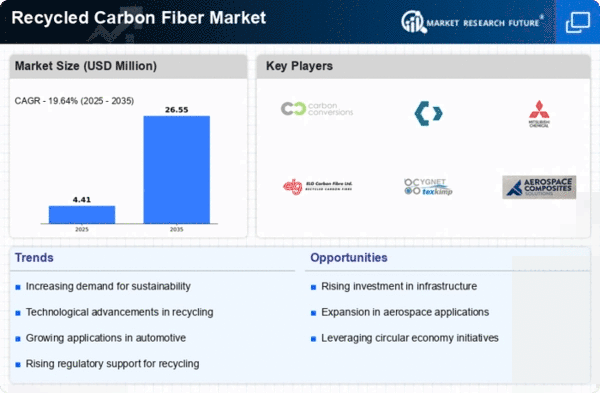

Recycled carbon fiber is emerging as a sustainable and cost-effective substitute for virgin carbon fibers, gaining traction in response to escalating demand for materials that are both recyclable and environmentally friendly. This surge in demand is closely linked to the surge in regulations advocating for the use of recyclable materials, creating promising prospects for participants in the worldwide recycled carbon fiber market. One notable example of regulatory support comes from the European Union's End of Life Vehicles Directive, which actively promotes recycling and provides incentives for the use of environmentally friendly vehicles. This directive is particularly impactful as end-of-life vehicles contribute to a substantial annual waste volume of eight to nine million tons within the European Community. The emphasis on recycling aligns with the global push towards sustainable practices, making recycled carbon fiber an attractive choice for industries aiming to comply with these regulations. Additionally, the Aircraft Fleet Recycling Association (AFRA) plays a pivotal role in advocating sustainable practices and the recycling of aircraft materials. This initiative underscores the broader trend of various sectors embracing eco-friendly solutions, contributing to the growing significance of recycled carbon fiber in the market. Furthermore, the worldwide challenge of limited landfill capacity for waste disposal has spurred a heightened demand for recyclable materials. As traditional waste disposal methods face constraints, industries are increasingly seeking sustainable alternatives, and recycled carbon fiber stands out as a viable and eco-conscious option. The versatile applications of recycled carbon fiber further contribute to its increasing consumption across diverse sectors. Industries such as wind energy, sports, and electronics are recognizing the superior properties of recycled carbon fiber, making it an attractive choice for various applications. Whether reinforcing structures in the wind energy sector, enhancing performance in sports equipment, or contributing to the lightweight design of electronic components, recycled carbon fiber is proving its worth across different domains. the surging adoption of recyclable and eco-friendly materials in major end-use industries is poised to create lucrative growth opportunities for participants in the global recycled carbon fiber market. Regulatory support, exemplified by directives like the EU's End of Life Vehicles Directive, combined with the broader global trend toward sustainability and the practical need for alternative waste disposal solutions, positions recycled carbon fiber as a pivotal player in the evolving landscape of material choices. As industries increasingly prioritize environmental responsibility, the demand for recycled carbon fiber is likely to expand, opening new avenues for market growth and innovation.

Leave a Comment