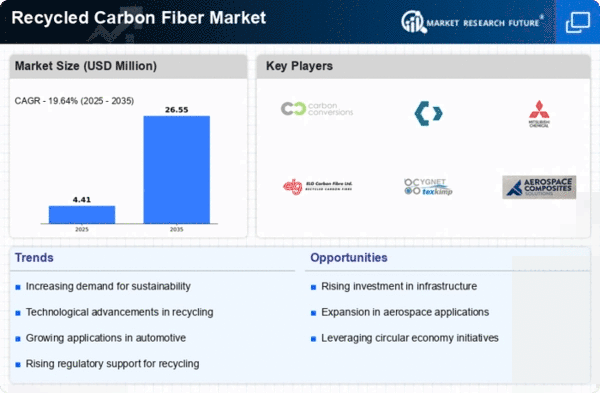

Market Growth Projections

The Global Recycled Carbon Fiber Market Industry is poised for substantial growth, with projections indicating a market size of 16.3 USD Billion in 2024 and an anticipated increase to 67.0 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate (CAGR) of 13.7% from 2025 to 2035. Such figures highlight the increasing recognition of recycled carbon fiber as a valuable resource in various applications, driven by sustainability initiatives and technological advancements. The market's expansion reflects broader trends toward circular economy practices and the integration of recycled materials into mainstream manufacturing processes.

Growing Demand for Sustainable Materials

The Global Recycled Carbon Fiber Market Industry experiences a surge in demand for sustainable materials across various sectors, including automotive and aerospace. As industries strive to reduce their carbon footprint, recycled carbon fiber emerges as a viable alternative to virgin materials. In 2024, the market is projected to reach 16.3 USD Billion, reflecting a growing awareness of environmental issues. Companies are increasingly adopting recycled carbon fiber to meet regulatory requirements and consumer preferences for eco-friendly products. This trend is likely to accelerate as more organizations commit to sustainability goals, thereby driving the growth of the Global Recycled Carbon Fiber Market Industry.

Regulatory Support for Recycling Initiatives

Government policies and regulations play a crucial role in promoting the use of recycled materials, including carbon fiber. The Global Recycled Carbon Fiber Market Industry benefits from initiatives aimed at reducing waste and encouraging recycling practices. Various countries are implementing stricter regulations on waste management and incentivizing the use of recycled materials in manufacturing processes. This regulatory support not only fosters a favorable environment for the growth of recycled carbon fiber but also aligns with global sustainability goals. As these policies evolve, they are likely to enhance the market's potential, contributing to a projected CAGR of 13.7% from 2025 to 2035.

Technological Advancements in Recycling Processes

Innovations in recycling technologies significantly enhance the efficiency and quality of recycled carbon fiber production. The Global Recycled Carbon Fiber Market Industry benefits from advancements such as improved separation techniques and enhanced processing methods, which increase the yield of high-quality recycled fibers. These technological improvements not only reduce production costs but also expand the range of applications for recycled carbon fiber. As a result, industries such as automotive and construction are increasingly integrating these materials into their products. The ongoing development of recycling technologies suggests a robust future for the Global Recycled Carbon Fiber Market Industry, potentially contributing to its projected growth to 67.0 USD Billion by 2035.

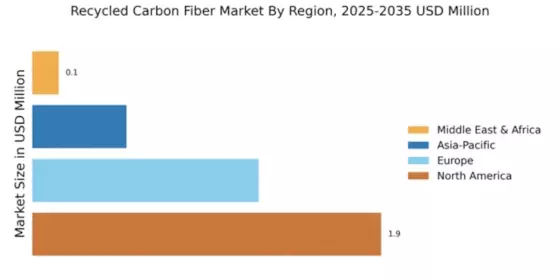

Increasing Applications in Automotive and Aerospace Industries

The automotive and aerospace sectors are increasingly adopting recycled carbon fiber due to its lightweight and high-strength properties. The Global Recycled Carbon Fiber Market Industry is witnessing a rise in applications such as structural components, interior design parts, and exterior panels. As manufacturers seek to improve fuel efficiency and reduce emissions, the demand for lightweight materials becomes paramount. Recycled carbon fiber offers a sustainable solution that meets these requirements. The growing emphasis on performance and sustainability in these industries is likely to drive the market forward, further solidifying the position of recycled carbon fiber as a key material in the Global Recycled Carbon Fiber Market Industry.

Rising Consumer Awareness and Preference for Eco-Friendly Products

Consumer awareness regarding environmental sustainability is on the rise, influencing purchasing decisions across various sectors. The Global Recycled Carbon Fiber Market Industry is benefiting from this shift, as consumers increasingly prefer products made from recycled materials. This trend is particularly evident in sectors such as fashion, automotive, and consumer goods, where brands are responding to consumer demand for eco-friendly alternatives. Companies that incorporate recycled carbon fiber into their products not only enhance their brand image but also tap into a growing market segment. This consumer-driven demand is expected to propel the growth of the Global Recycled Carbon Fiber Market Industry in the coming years.