Increased Focus on Aesthetic Appeal

The Residential Lighting Fixture Market is witnessing a heightened focus on aesthetic appeal as consumers prioritize design and style in their homes. Lighting fixtures are no longer merely functional; they are increasingly viewed as integral components of interior design. In 2025, it is anticipated that decorative lighting will represent a significant portion of the market, with consumers seeking unique and customizable options. This trend is further fueled by the rise of social media platforms, where homeowners showcase their interior designs, prompting others to invest in visually appealing lighting solutions. Manufacturers are responding by offering a diverse range of styles, colors, and finishes, thereby enhancing the overall aesthetic value of residential spaces and driving growth in the Residential Lighting Fixture Market.

Technological Advancements in Lighting

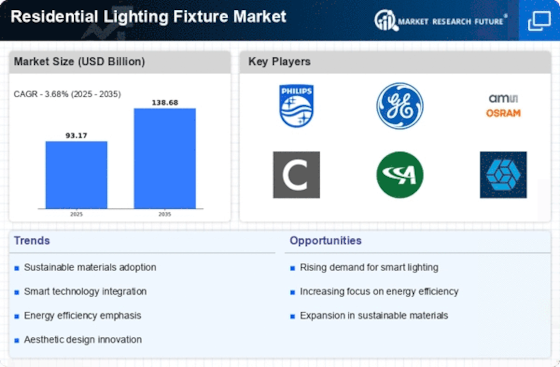

Technological advancements are significantly influencing the Residential Lighting Fixture Market. The integration of smart technology into lighting solutions is becoming increasingly prevalent. Smart lighting systems, which allow users to control their fixtures remotely via smartphones or voice-activated devices, are gaining traction among consumers. In 2025, it is projected that the smart lighting segment will grow at a compound annual growth rate of over 20%. This growth is driven by the increasing popularity of home automation and the desire for enhanced convenience and energy management. As manufacturers continue to innovate and introduce new features, the Residential Lighting Fixture Market is likely to see a substantial transformation, appealing to tech-savvy consumers seeking modern lighting solutions.

Regulatory Support for Energy Standards

Regulatory support for energy standards is playing a crucial role in shaping the Residential Lighting Fixture Market. Governments worldwide are implementing stricter energy efficiency regulations, which are compelling manufacturers to innovate and produce compliant products. In 2025, it is expected that regulations will mandate higher energy efficiency ratings for lighting fixtures, pushing the market towards more sustainable options. This regulatory environment not only encourages the adoption of energy-efficient technologies but also fosters competition among manufacturers to develop cutting-edge solutions. As a result, the Residential Lighting Fixture Market is likely to experience accelerated growth, driven by the need for compliance and the increasing consumer preference for energy-efficient lighting solutions.

Growing Renovation and Remodeling Activities

The Residential Lighting Fixture Market is benefiting from a surge in renovation and remodeling activities. As homeowners increasingly invest in upgrading their living spaces, the demand for modern lighting fixtures is on the rise. In 2025, it is estimated that the home improvement market will reach a valuation of over 400 billion dollars, with lighting being a key focus area. This trend is driven by the desire to enhance home value and improve energy efficiency. Homeowners are more inclined to replace outdated fixtures with contemporary designs that offer better performance and aesthetics. Consequently, this growing trend in renovations is likely to propel the Residential Lighting Fixture Market, as consumers seek innovative lighting solutions to complement their upgraded interiors.

Rising Demand for Energy Efficient Solutions

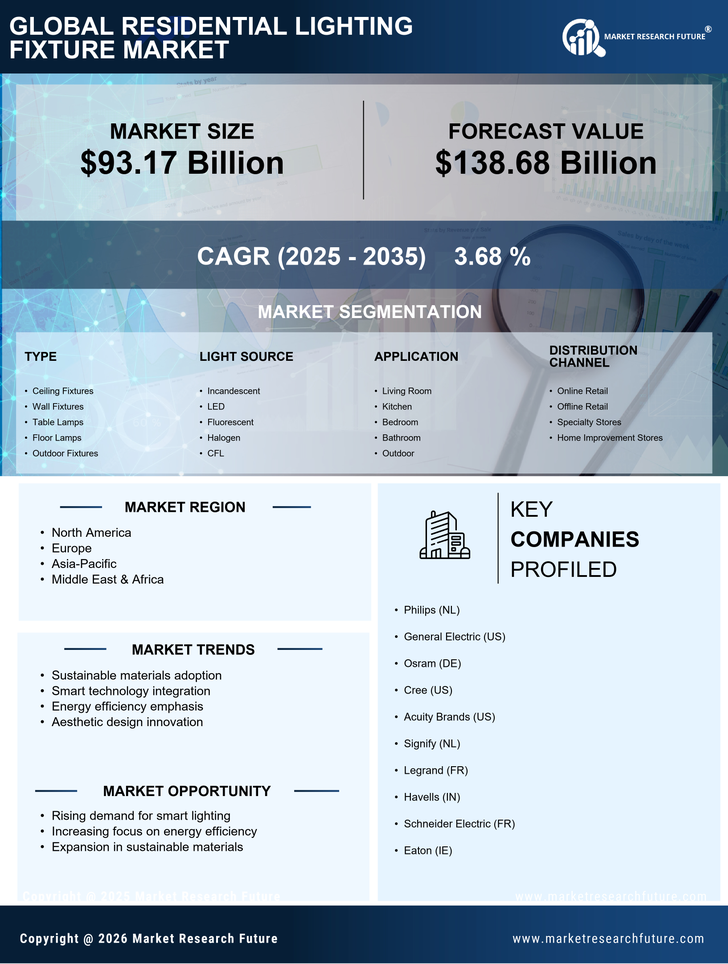

The Residential Lighting Fixture Market is experiencing a notable shift towards energy-efficient solutions. As consumers become increasingly aware of environmental issues, the demand for LED lighting fixtures has surged. In 2025, it is estimated that LED lighting will account for over 60% of the total lighting market. This transition not only reduces energy consumption but also lowers electricity bills, making it an attractive option for homeowners. Furthermore, government initiatives promoting energy efficiency are likely to bolster this trend, as rebates and incentives encourage the adoption of sustainable lighting solutions. Consequently, manufacturers are focusing on developing innovative, energy-efficient products to meet this growing demand, thereby driving the Residential Lighting Fixture Market forward.