Russia Metal Forging Market Summary

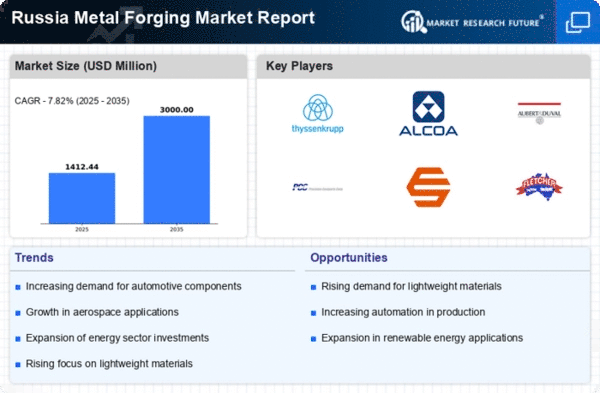

As per Market Research Future analysis, the Metal Forging market Size was estimated at 1310.0 USD Million in 2024. The metal forging market is projected to grow from 1412.44 USD Million in 2025 to 3000.0 USD Million by 2035, exhibiting a compound annual growth rate (CAGR) of 7.8% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Russia metal forging market is experiencing a dynamic shift driven by technological advancements and sustainability initiatives.

- Technological advancements are enhancing production efficiency and product quality in the metal forging sector.

- The demand for high-performance materials is rising, particularly in the automotive and aerospace segments.

- Sustainability initiatives are becoming increasingly important, influencing manufacturing processes and material selection.

- Infrastructure development and automotive sector growth are key drivers propelling the market forward.

Market Size & Forecast

| 2024 Market Size | 1310.0 (USD Million) |

| 2035 Market Size | 3000.0 (USD Million) |

| CAGR (2025 - 2035) | 7.82% |

Major Players

Thyssenkrupp AG (DE), Alcoa Corporation (US), Aubert & Duval (FR), Precision Castparts Corp (US), Forged Solutions Group (GB), Fletcher International (AU), Bharat Forge Limited (IN), Shaanxi Fast Gear (CN)