Increased Demand from the Construction Sector

The Soil Compaction Equipment Market is experiencing heightened demand driven by the construction sector's robust growth. As construction activities ramp up, the need for effective soil compaction solutions becomes paramount to ensure structural integrity. The construction industry is projected to grow at a rate of 4.5% annually, leading to an increased requirement for soil compaction equipment. This growth is particularly evident in emerging markets, where infrastructure development is a priority. Companies are investing in advanced compaction technologies to enhance productivity and reduce project timelines. The rising demand from the construction sector is expected to significantly influence the soil compaction equipment market, with projections indicating a potential market size increase of over 20% by 2027.

Sustainability Focus in Construction Practices

The Soil Compaction Equipment Market is significantly influenced by the growing emphasis on sustainability within construction practices. As environmental regulations become more stringent, there is a rising demand for equipment that minimizes ecological impact. Companies are increasingly seeking soil compaction solutions that utilize less energy and produce fewer emissions. This shift is reflected in the market, where eco-friendly equipment options are gaining traction. For example, the adoption of electric-powered compactors is on the rise, as they align with sustainability goals while maintaining performance standards. Market analysis suggests that the demand for sustainable soil compaction equipment could account for nearly 30% of total sales by 2026, highlighting the industry's commitment to environmentally responsible practices.

Rising Urbanization and Infrastructure Development

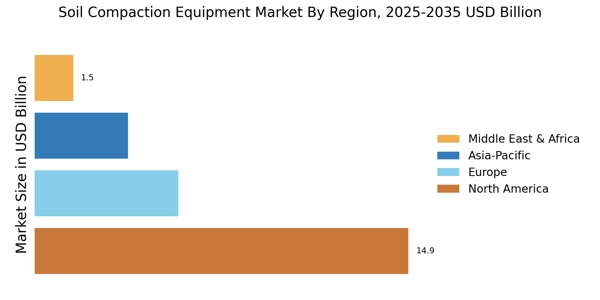

The Soil Compaction Equipment Market is poised for growth due to the ongoing trend of rising urbanization and infrastructure development. As urban areas expand, the need for robust infrastructure, including roads, bridges, and buildings, becomes increasingly critical. This demand drives the need for effective soil compaction solutions to ensure the stability and longevity of construction projects. Recent statistics indicate that urbanization rates are projected to increase, with an estimated 68% of the world's population expected to reside in urban areas by 2050. Consequently, the soil compaction equipment market is likely to see a surge in demand, as construction companies seek reliable equipment to meet the challenges posed by rapid urban growth.

Technological Advancements in Soil Compaction Equipment

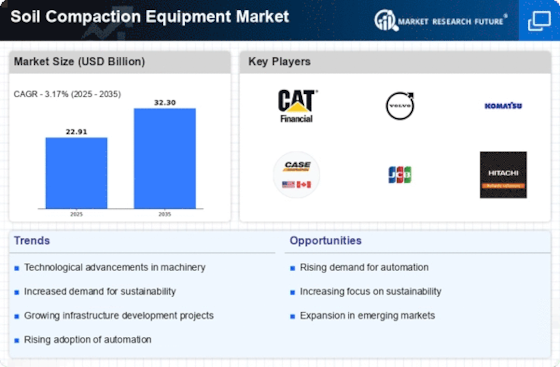

The Soil Compaction Equipment Market is experiencing a notable transformation due to rapid technological advancements. Innovations such as automated compaction systems and telematics are enhancing operational efficiency and precision. For instance, the integration of GPS technology allows for real-time monitoring of compaction processes, which can lead to improved outcomes in construction projects. Furthermore, manufacturers are increasingly adopting electric and hybrid models, which not only reduce emissions but also lower operational costs. According to recent data, the market for advanced soil compaction equipment is projected to grow at a compound annual growth rate of approximately 5.2% over the next few years. This trend indicates a shift towards more sophisticated machinery that meets the evolving demands of the construction and civil engineering sectors.

Government Initiatives and Funding for Infrastructure Projects

The Soil Compaction Equipment Market is benefiting from various government initiatives aimed at enhancing infrastructure development. Many governments are allocating substantial budgets for public works projects, which include road construction, transportation networks, and urban renewal initiatives. These investments create a favorable environment for the soil compaction equipment market, as contractors require advanced machinery to meet project specifications. For instance, recent government funding programs have been established to support infrastructure improvements, which could lead to increased procurement of soil compaction equipment. Analysts predict that this trend will continue, with government spending on infrastructure projected to rise by 4% annually over the next five years, further stimulating demand in the soil compaction equipment sector.