Rising Demand for Sustainable Practices

The agriculture analytics market in South America is experiencing a notable shift towards sustainable farming practices. As consumers increasingly prioritize environmentally friendly products, farmers are compelled to adopt analytics-driven solutions that enhance resource efficiency. This trend is reflected in the growing market for precision agriculture technologies, which is projected to reach approximately $2.5 billion by 2026 in the region. By leveraging data analytics, farmers can optimize water usage, reduce chemical inputs, and improve crop yields, thereby aligning with sustainability goals. The agriculture analytics market is thus positioned to play a crucial role in facilitating this transition, as it provides the necessary tools for monitoring and managing agricultural practices sustainably.

Climate Change and Its Impact on Agriculture

The agriculture analytics market in South America is increasingly shaped by the challenges posed by climate change. Farmers are facing unpredictable weather patterns, which necessitate the use of analytics to adapt and mitigate risks. By employing data analytics, farmers can better understand climate impacts on crop yields and make informed decisions regarding planting and harvesting schedules. The agriculture analytics market is likely to see growth as farmers seek solutions that help them navigate these challenges. The urgency to address climate-related issues is driving the demand for analytics tools that provide insights into sustainable practices and resilience strategies.

Growing Investment in Agricultural Technology

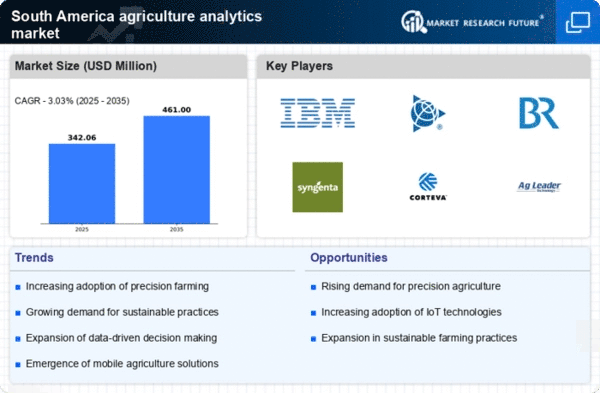

Investment in agricultural technology is a driving force behind the agriculture analytics market in South America. Venture capital and government funding are increasingly directed towards innovative agri-tech startups that focus on data analytics solutions. This influx of capital is fostering the development of advanced analytics platforms that cater to the specific needs of local farmers. For instance, the market for agricultural software solutions is anticipated to grow at a CAGR of 15% through 2027. As these investments continue to rise, the agriculture analytics market is expected to flourish, providing farmers with the tools necessary to improve productivity and profitability.

Technological Advancements in Data Collection

The agriculture analytics market in South America is significantly influenced by advancements in data collection technologies. Innovations such as IoT devices, drones, and satellite imagery are revolutionizing how farmers gather and analyze data. These technologies enable real-time monitoring of crop health, soil conditions, and weather patterns, which are essential for informed decision-making. The integration of these tools into farming operations is expected to increase efficiency and productivity, with the market for agricultural drones alone projected to exceed $1 billion by 2025. Consequently, the agriculture analytics market is likely to expand as farmers increasingly adopt these technologies to enhance their operational capabilities.

Increasing Awareness of Data-Driven Decision Making

There is a growing awareness among farmers in South America regarding the benefits of data-driven decision making in agriculture. As educational initiatives and workshops proliferate, more farmers are recognizing the value of utilizing analytics to enhance their farming practices. This shift is likely to lead to a greater adoption of analytics tools, as farmers seek to improve yield and reduce costs. The agriculture analytics market is thus poised for growth, as the demand for training and resources to support this transition becomes more pronounced. The potential for increased efficiency and profitability through informed decision making is driving this trend.

Leave a Comment