Investment in Healthcare Infrastructure

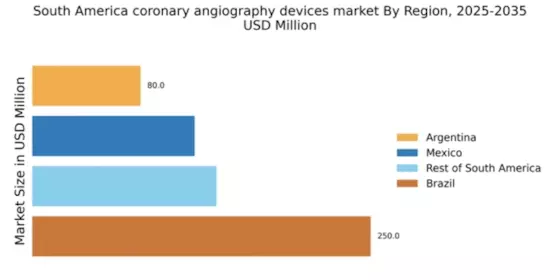

Investment in healthcare infrastructure across South America is a crucial factor propelling the coronary angiography-devices market. Governments and private entities are increasingly allocating funds to enhance healthcare facilities, particularly in urban areas. For instance, Brazil and Argentina have announced multi-million dollar initiatives aimed at upgrading hospitals and clinics, which include the procurement of advanced medical equipment. This investment is expected to improve access to coronary angiography services, thereby driving demand for related devices. The coronary angiography-devices market stands to benefit from these developments, as enhanced infrastructure will facilitate the adoption of innovative technologies and improve patient care. Moreover, the establishment of specialized cardiac centers is likely to further stimulate market growth, as these centers require state-of-the-art angiography devices to provide comprehensive cardiovascular care.

Growing Awareness of Preventive Healthcare

There is a notable increase in awareness regarding preventive healthcare measures among the South American population, which is positively influencing the coronary angiography-devices market. Educational campaigns and health initiatives aimed at promoting heart health have led to a greater understanding of the importance of early detection of cardiovascular diseases. As a result, more individuals are seeking diagnostic procedures, including coronary angiography, to assess their heart health. This shift towards preventive care is expected to drive the demand for angiography devices, as healthcare providers respond to the growing patient interest. The coronary angiography-devices market is likely to see a surge in sales as patients become more proactive in managing their cardiovascular health, leading to increased utilization of these essential diagnostic tools.

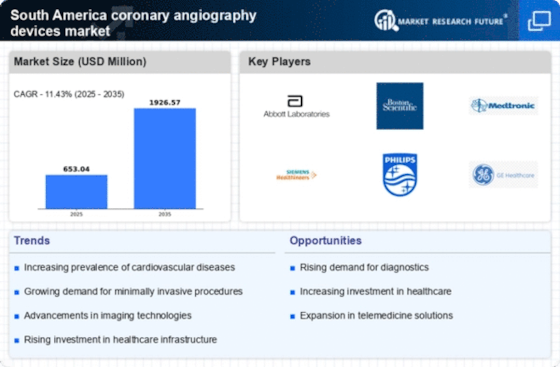

Rising Incidence of Cardiovascular Diseases

The increasing prevalence of cardiovascular diseases in South America is a primary driver for the coronary angiography-devices market. According to health statistics, cardiovascular diseases account for approximately 30% of all deaths in the region. This alarming trend necessitates advanced diagnostic tools, including coronary angiography devices, to facilitate early detection and treatment. As healthcare providers strive to improve patient outcomes, the demand for these devices is expected to rise significantly. Furthermore, the aging population in South America, which is projected to grow by 20% by 2030, contributes to the higher incidence of heart-related ailments. Consequently, the coronary angiography-devices market is likely to experience robust growth as healthcare systems adapt to meet the increasing needs of patients suffering from cardiovascular conditions.

Technological Innovations in Medical Devices

Technological innovations in medical devices are significantly impacting the coronary angiography-devices market in South America. The introduction of advanced imaging technologies, such as 3D imaging and enhanced visualization techniques, is revolutionizing the way coronary angiography is performed. These innovations not only improve the accuracy of diagnoses but also enhance the overall patient experience. As healthcare providers seek to adopt the latest technologies to remain competitive, the demand for state-of-the-art coronary angiography devices is expected to rise. The coronary angiography-devices market is poised for growth as manufacturers continue to invest in research and development to create cutting-edge solutions that meet the evolving needs of healthcare professionals and patients alike.

Regulatory Support for Medical Device Approvals

Regulatory support for medical device approvals in South America is emerging as a key driver for the coronary angiography-devices market. Regulatory bodies in countries such as Brazil and Argentina are streamlining the approval processes for medical devices, making it easier for manufacturers to bring innovative products to market. This supportive regulatory environment encourages investment in the development of new coronary angiography technologies, which can lead to improved patient outcomes. As a result, the coronary angiography-devices market is likely to benefit from an influx of new products that enhance diagnostic capabilities. Furthermore, the expedited approval processes may lead to increased competition among manufacturers, ultimately driving down costs and improving accessibility for healthcare providers and patients.