Market Growth Projections

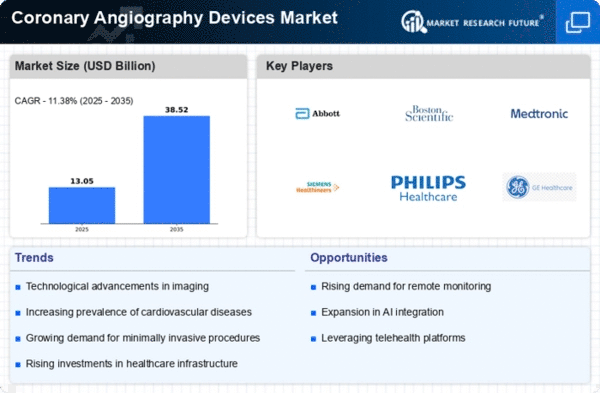

Projected growth in the Global Coronary Angiography Devices Market Industry indicates a robust trajectory, with expectations of reaching 28.3 USD Billion by 2035. This growth is underpinned by various factors, including technological advancements, rising healthcare expenditure, and increasing prevalence of cardiovascular diseases. The compound annual growth rate of 4.92% from 2025 to 2035 suggests a sustained demand for innovative angiography solutions. Such projections highlight the importance of continuous investment in research and development to meet the evolving needs of healthcare providers and patients.

Rising Healthcare Expenditure

The upward trend in global healthcare expenditure is a significant driver for the Global Coronary Angiography Devices Market Industry. As nations allocate more resources to healthcare, there is an increased focus on advanced diagnostic technologies, including coronary angiography devices. This financial commitment enables healthcare facilities to invest in the latest equipment, thereby enhancing patient care. The anticipated growth in market value to 28.3 USD Billion by 2035 reflects this trend, as healthcare systems prioritize investments in technologies that improve diagnostic capabilities and treatment outcomes.

Government Initiatives and Funding

Government initiatives aimed at improving healthcare infrastructure and funding for cardiovascular research play a crucial role in the expansion of the Global Coronary Angiography Devices Market Industry. Various countries are investing in healthcare systems to enhance access to advanced diagnostic tools. For instance, public health programs that promote early detection and treatment of heart diseases are likely to increase the utilization of coronary angiography devices. This supportive environment is expected to contribute to a compound annual growth rate of 4.92% from 2025 to 2035, reflecting a commitment to improving cardiovascular health outcomes.

Increasing Awareness and Education

Growing awareness regarding cardiovascular health and the importance of early diagnosis is driving the demand for coronary angiography devices. Educational campaigns aimed at both healthcare professionals and the general public are fostering a better understanding of heart diseases and the role of angiography in their management. The Global Coronary Angiography Devices Market Industry benefits from this heightened awareness, as more individuals seek diagnostic procedures to assess their cardiovascular health. This trend is likely to sustain market growth, as informed patients are more inclined to pursue advanced diagnostic options.

Rising Prevalence of Cardiovascular Diseases

The increasing incidence of cardiovascular diseases globally drives the demand for coronary angiography devices. As per health statistics, cardiovascular diseases remain a leading cause of mortality, necessitating advanced diagnostic tools. The Global Coronary Angiography Devices Market Industry is responding to this urgent need, with projections indicating a market value of 16.7 USD Billion in 2024. This growth is likely to be fueled by the aging population and lifestyle changes that contribute to heart-related ailments, thereby enhancing the adoption of angiography procedures and devices.

Technological Advancements in Angiography Devices

Innovations in coronary angiography technology significantly enhance diagnostic accuracy and patient outcomes. The introduction of advanced imaging techniques, such as 3D angiography and hybrid imaging systems, is transforming the Global Coronary Angiography Devices Market Industry. These advancements not only improve visualization of coronary arteries but also reduce procedural risks. As a result, healthcare providers are increasingly adopting these state-of-the-art devices, contributing to the projected growth of the market, which is expected to reach 28.3 USD Billion by 2035. Such technological progress is pivotal in addressing the complexities of cardiovascular diagnostics.