Aging Population

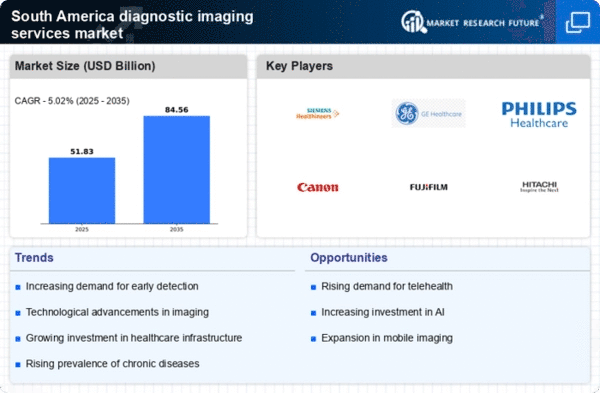

The demographic shift towards an aging population in South America significantly influences the diagnostic imaging-services market. As the population ages, the prevalence of chronic diseases such as cancer, cardiovascular conditions, and neurological disorders increases, necessitating advanced diagnostic imaging services. For example, it is projected that by 2030, individuals aged 60 and above will constitute over 20% of the population in countries like Argentina and Chile. This demographic trend creates a heightened demand for imaging services, as older adults typically require more frequent diagnostic evaluations. Consequently, healthcare providers are likely to invest in imaging technologies to cater to this growing patient demographic, thereby propelling the diagnostic imaging-services market forward.

Increasing Healthcare Expenditure

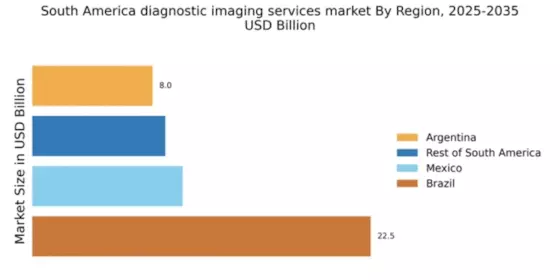

The rising healthcare expenditure in South America is a pivotal driver for the diagnostic imaging-services market. Governments and private sectors are allocating more funds towards healthcare infrastructure, which includes advanced imaging technologies. For instance, Brazil's healthcare spending reached approximately $200 billion in 2025, reflecting a growth of around 10% from previous years. This increase in investment facilitates the acquisition of state-of-the-art imaging equipment, thereby enhancing diagnostic capabilities. Furthermore, as healthcare budgets expand, there is a corresponding rise in the demand for diagnostic imaging services, which are essential for accurate disease detection and management. This trend indicates a robust growth trajectory for the diagnostic imaging-services market in the region, as stakeholders seek to improve patient outcomes through better diagnostic tools.

Expansion of Healthcare Facilities

The expansion of healthcare facilities across South America is a crucial driver for the diagnostic imaging-services market. As new hospitals and clinics are established, there is an increasing need for comprehensive diagnostic services, including imaging. Countries like Colombia and Peru are witnessing a surge in healthcare infrastructure development, with investments exceeding $5 billion in 2025 alone. This expansion is not only improving access to healthcare but also fostering competition among providers, which can lead to enhanced service offerings and lower costs for patients. Consequently, the growth in healthcare facilities is likely to stimulate demand for diagnostic imaging services, thereby contributing to the overall expansion of the market.

Rising Awareness of Early Diagnosis

There is a notable increase in public awareness regarding the importance of early diagnosis in South America, which serves as a significant driver for the diagnostic imaging-services market. Educational campaigns and health initiatives are emphasizing the benefits of early detection of diseases, leading to a surge in patient demand for imaging services. For instance, studies indicate that early diagnosis can improve treatment outcomes by up to 30%. This growing awareness is prompting healthcare facilities to expand their imaging capabilities, ensuring they can meet the rising demand. As a result, the diagnostic imaging-services market is likely to experience substantial growth, as more individuals seek preventive healthcare measures and timely interventions.

Technological Integration in Healthcare

The integration of advanced technologies such as artificial intelligence (AI) and machine learning into healthcare systems is transforming the diagnostic imaging-services market. In South America, healthcare providers are increasingly adopting these technologies to enhance imaging accuracy and efficiency. For example, AI algorithms can analyze imaging data more rapidly and accurately than traditional methods, potentially reducing diagnostic errors by up to 20%. This technological evolution not only improves patient outcomes but also streamlines operational processes within healthcare facilities. As more institutions recognize the benefits of integrating technology into their imaging services, the diagnostic imaging-services market is expected to expand, driven by the demand for innovative solutions that enhance diagnostic capabilities.