Rising Awareness of Biosimilars

There is a growing awareness among healthcare professionals and patients regarding the benefits of biosimilars in South America. Educational initiatives and outreach programs are helping to dispel misconceptions about the safety and efficacy of these products. As knowledge increases, the insulin biosimilars market is likely to experience a shift in perception, leading to higher acceptance and utilization of biosimilars. This increased awareness could potentially drive market growth, with projections indicating a rise of approximately 12% in the adoption of insulin biosimilars over the next few years. The proactive engagement of healthcare providers in educating patients about biosimilars is crucial for fostering trust and encouraging their use.

Technological Advancements in Biologics

Technological advancements in the production and formulation of biologics are playing a crucial role in the insulin biosimilars market. Innovations in manufacturing processes, such as improved cell culture techniques and purification methods, are enhancing the quality and efficacy of biosimilars. These advancements not only ensure that biosimilars meet regulatory standards but also contribute to cost reductions in production. As a result, the insulin biosimilars market is likely to see an influx of new products that are both effective and affordable. The introduction of advanced biosimilars could potentially capture a larger market share, with estimates suggesting that the market could grow by 18% in the coming years due to these technological improvements. This trend indicates a promising future for the industry.

Increasing Demand for Affordable Medications

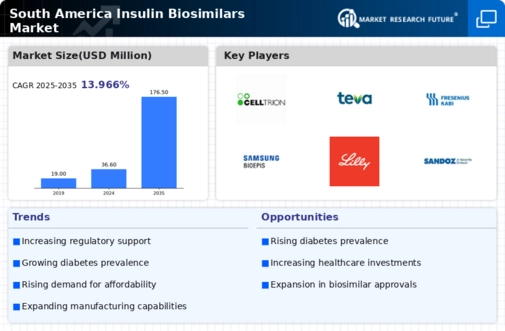

The rising cost of healthcare in South America has led to an increasing demand for affordable medications, particularly in the insulin biosimilars market. Patients and healthcare providers are seeking cost-effective alternatives to branded insulin products. The insulin biosimilars market is expected to benefit from this trend, as these products typically offer lower prices compared to their reference biologics. In South America, where healthcare budgets are often constrained, the adoption of biosimilars could potentially reduce overall healthcare expenditures. Reports indicate that the market for insulin biosimilars could grow by approximately 15% annually, driven by this demand for affordability. As more patients gain access to these alternatives, the insulin biosimilars market is likely to expand significantly.

Government Initiatives for Diabetes Management

Governments across South America are increasingly recognizing the need for effective diabetes management strategies. This has led to the implementation of various initiatives aimed at improving access to diabetes medications, including insulin biosimilars. The insulin biosimilars market is poised to benefit from these government efforts, which may include subsidies, public health campaigns, and educational programs. For instance, some countries have introduced policies to promote the use of biosimilars in public health systems, thereby enhancing patient access. Such initiatives could potentially increase the market penetration of insulin biosimilars, contributing to a projected market growth of around 20% over the next few years. This proactive approach by governments underscores the importance of addressing diabetes as a public health priority.

Competitive Landscape and Market Entry of New Players

The competitive landscape of the insulin biosimilars market in South America is evolving, with new players entering the market. This influx of competition is likely to drive innovation and lower prices, benefiting consumers. Established pharmaceutical companies are increasingly investing in the development of biosimilars, while smaller biotech firms are also emerging with novel products. The presence of multiple players in the market could lead to a more dynamic environment, fostering collaboration and partnerships that enhance product offerings. Analysts suggest that this competitive environment may result in a market growth rate of around 16% as new entrants challenge existing products and stimulate demand for insulin biosimilars. The potential for increased competition is a key driver for the industry.