Expansion of Biotechnology Sector

The biotechnology sector in South America is expanding rapidly, which is significantly impacting the laboratory equipment market. With a focus on research and development, biotechnology firms are increasingly investing in sophisticated laboratory instruments to support their innovative processes. The market for laboratory equipment is expected to reach $1.2 billion by 2026, driven by the need for high-quality equipment that meets stringent regulatory standards. This growth is indicative of a broader trend where the intersection of technology and biology is fostering advancements in drug development and genetic research, thereby creating a robust demand for laboratory equipment.

Rising Demand for Diagnostic Testing

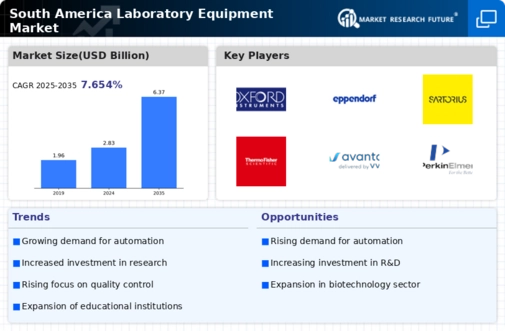

The laboratory equipment market in South America is experiencing a notable surge in demand for diagnostic testing. This trend is driven by an increasing prevalence of chronic diseases and a growing emphasis on preventive healthcare. As healthcare providers seek to enhance patient outcomes, the need for advanced diagnostic tools becomes paramount. The market for laboratory equipment is projected to grow at a CAGR of approximately 7.5% over the next five years, reflecting the urgency for accurate and efficient testing solutions. Furthermore, government initiatives aimed at improving healthcare infrastructure are likely to bolster investments in laboratory facilities, thereby further stimulating the laboratory equipment market in the region.

Emergence of Educational Institutions

The emergence of new educational institutions in South America is contributing to the growth of the laboratory equipment market. As universities and technical colleges expand their science and engineering programs, the demand for laboratory equipment is likely to increase. These institutions require modern and efficient equipment to provide students with hands-on experience in scientific research. The laboratory equipment market is expected to see a growth rate of 6% as educational institutions invest in upgrading their facilities. This trend not only enhances the quality of education but also prepares a skilled workforce, which is essential for the continued advancement of the laboratory equipment market.

Growing Focus on Environmental Testing

The growing focus on environmental testing in South America is influencing the laboratory equipment market significantly. As concerns regarding pollution and environmental degradation rise, regulatory bodies are mandating stricter testing protocols for air, water, and soil quality. This shift necessitates the acquisition of advanced laboratory equipment capable of performing complex analyses. The market is projected to grow by 8% annually as industries and governmental agencies invest in reliable testing solutions to comply with environmental regulations. Consequently, the laboratory equipment market is poised to benefit from this heightened awareness and regulatory pressure, leading to increased demand for specialized equipment.

Government Funding for Scientific Research

Government funding for scientific research in South America is a critical driver of the laboratory equipment market. Increased allocations for research initiatives are enabling institutions to acquire state-of-the-art laboratory equipment, which is essential for conducting high-quality experiments. In recent years, several South American countries have announced funding programs aimed at enhancing research capabilities, which could lead to a 10% increase in laboratory equipment purchases. This influx of capital not only supports academic institutions but also encourages private sector collaboration, thereby fostering a vibrant ecosystem for scientific innovation and growth in the laboratory equipment market.