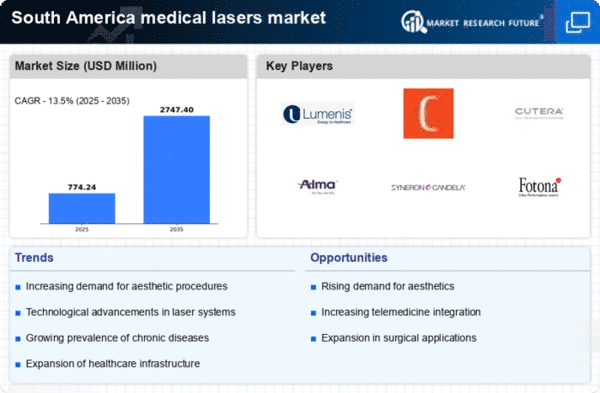

Growing Aesthetic Procedures

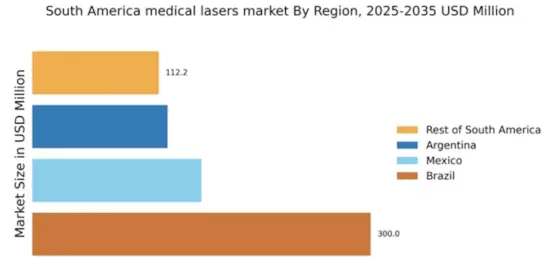

The burgeoning interest in aesthetic procedures among the South American population significantly influences the medical lasers market. With an increasing number of individuals seeking cosmetic treatments, the demand for laser technologies has escalated. In countries like Brazil and Argentina, the aesthetic market is expected to grow at a CAGR of around 10% through 2025. Medical lasers are integral to various cosmetic procedures, including hair removal, skin resurfacing, and tattoo removal. This trend is further fueled by the rising awareness of non-invasive treatment options, which are perceived as safer and more effective. As more clinics and practitioners adopt advanced laser technologies to meet consumer demands, the medical lasers market is poised for substantial growth in South America.

Increasing Healthcare Expenditure

The rising healthcare expenditure in South America is a pivotal driver for the medical lasers market. Governments and private sectors are investing more in healthcare infrastructure, which includes advanced medical technologies. For instance, Brazil's healthcare spending is projected to reach approximately $200 billion by 2025, indicating a growing market for medical devices, including lasers. This increase in funding allows for the acquisition of state-of-the-art medical lasers, enhancing treatment options in various medical fields such as dermatology, ophthalmology, and surgery. As healthcare facilities upgrade their equipment, the demand for innovative medical lasers is likely to surge, thereby propelling market growth. Furthermore, the emphasis on improving patient outcomes and operational efficiency in healthcare settings further supports the expansion of the medical lasers market in the region.

Expansion of Telemedicine Services

The expansion of telemedicine services in South America is emerging as a significant driver for the medical lasers market. As healthcare providers increasingly adopt telehealth solutions, there is a growing need for advanced diagnostic and treatment technologies that can be utilized remotely. Medical lasers, particularly in dermatology and ophthalmology, can be integrated into telemedicine platforms, allowing practitioners to offer consultations and follow-up treatments without the need for in-person visits. This shift not only enhances patient access to care but also encourages the adoption of laser technologies in remote areas. The telemedicine market in South America is expected to grow by over 30% by 2025, indicating a substantial opportunity for the medical lasers market to align with this trend and cater to a broader patient base.

Rising Incidence of Chronic Diseases

The increasing incidence of chronic diseases in South America is a critical factor driving the medical lasers market. Conditions such as diabetes, cardiovascular diseases, and skin disorders are on the rise, necessitating advanced treatment options. Medical lasers are increasingly utilized in the management of these conditions, offering minimally invasive solutions that improve patient outcomes. For example, laser therapies are employed in diabetic retinopathy treatment and skin rejuvenation for patients with chronic skin conditions. The World Health Organization reports that chronic diseases account for approximately 60% of all deaths in the region, highlighting the urgent need for effective medical interventions. As healthcare systems respond to this growing burden, the demand for medical lasers is likely to increase, fostering market growth.

Technological Integration in Healthcare

The integration of advanced technologies in healthcare is a notable driver for the medical lasers market in South America. Innovations such as artificial intelligence, machine learning, and robotics are being incorporated into medical laser systems, enhancing their precision and efficacy. This technological evolution allows for more accurate treatments and improved patient safety. For instance, AI-driven laser systems can assist in real-time decision-making during procedures, optimizing outcomes. The medical lasers market is expected to benefit from this trend, as healthcare providers seek to adopt cutting-edge technologies to stay competitive. As the region's healthcare landscape evolves, the demand for technologically advanced medical lasers is likely to rise, further propelling market growth.