Sports Drink Size

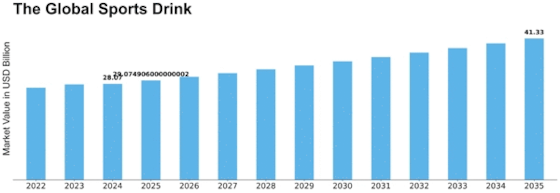

Sports drink Market Growth Projections and Opportunities

The sports drink market is shaped by various factors that influence its dynamics and growth. One crucial element is consumer behavior and lifestyle choices. As more individuals engage in physical activities and sports, there is a growing demand for beverages that can replenish electrolytes and provide hydration. Consumers often seek sports drinks as a convenient and effective way to recover after exercising, contributing to the market's expansion.

Economic conditions also play a pivotal role in the sports drink market. The disposable income of consumers influences their spending on non-essential items, including sports beverages. During periods of economic stability, consumers may be more willing to invest in premium or branded sports drinks, while economic downturns may lead to a shift towards more affordable options. The economic climate directly impacts the purchasing power of consumers in the sports drink market.

Globalization is another key factor, contributing to the diversification of sports drinks. International sports drink brands introduce a variety of flavors and formulations to cater to different cultural preferences. This globalization has led to cross-cultural exchanges, influencing the types of sports drinks available in various regions. Local adaptations and innovations also arise as companies respond to the specific needs and tastes of different markets.

Advancements in technology play a significant role in the sports drink market. The development of sports nutrition science and the understanding of optimal hydration contribute to the formulation of enhanced sports drinks. Additionally, technological innovations in packaging, such as resealable bottles and ergonomic designs, improve the convenience of sports drinks for consumers engaged in physical activities.

Health and wellness trends have a profound impact on the sports drink market. With an increasing focus on fitness and healthy living, consumers are becoming more conscious of the ingredients in their beverages. This trend has prompted the development of sports drinks with natural flavors, reduced sugar content, and added functional ingredients like vitamins and electrolytes. Companies that align with these health-conscious preferences often gain a competitive advantage in the market.

Government regulations and health standards also influence the sports drink market. Compliance with labeling requirements, nutritional information, and safety standards is crucial for building consumer trust. Regulatory changes related to the use of certain ingredients or health claims can affect the formulation and marketing strategies of sports drink brands.

Competition is a significant driver in the sports drink market, with various brands vying for market share. Marketing strategies, sponsorships, and endorsements with athletes contribute to brand visibility and influence consumer perceptions. Companies often engage in continuous innovation to differentiate their products, introducing new flavors, formulations, and packaging options to stay ahead in the competitive landscape.

Social and cultural factors shape consumer preferences within the sports drink market. Cultural attitudes toward physical fitness and wellness, as well as lifestyle choices, impact the demand for sports drinks. Social trends, such as the rise of fitness influencers and wellness movements, can drive consumer choices within the sports drink category.

Leave a Comment