Expansion of the Automotive Sector

The automotive sector's expansion is significantly influencing the Thin Wafer Market. With the rise of electric vehicles and advanced driver-assistance systems, there is an increasing need for sophisticated semiconductor components. Thin wafers are essential for the miniaturization of electronic systems in vehicles, enabling features such as enhanced connectivity and improved safety. The automotive semiconductor market is expected to grow at a compound annual growth rate of around 8%, reflecting the industry's shift towards more electronic content in vehicles. This trend suggests that the Thin Wafer Market will play a crucial role in supporting the automotive sector's evolution, particularly as manufacturers seek to integrate more advanced technologies.

Rising Demand for Consumer Electronics

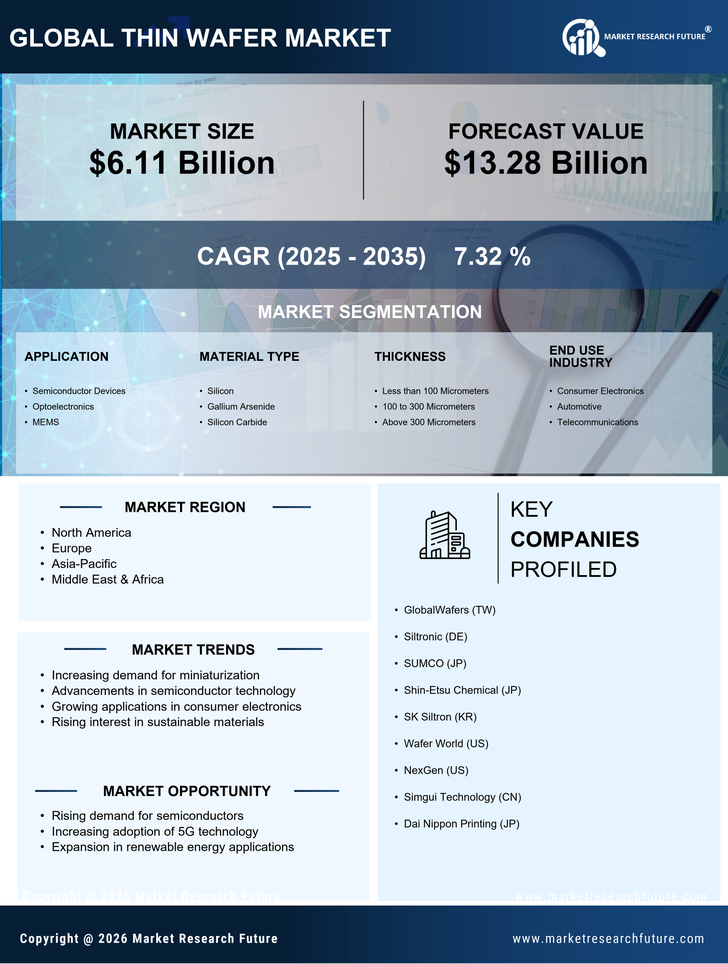

The Thin Wafer Market is experiencing a notable surge in demand driven by the proliferation of consumer electronics. As devices become increasingly compact and efficient, manufacturers are seeking thinner wafers to enhance performance while minimizing size. The market for smartphones, tablets, and wearables is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 10% in the coming years. This trend necessitates the adoption of thin wafers, which facilitate the production of smaller, lighter, and more powerful devices. Consequently, the Thin Wafer Market is poised to benefit from this consumer electronics boom, as manufacturers strive to meet the evolving preferences of tech-savvy consumers.

Growing Interest in Renewable Energy Solutions

The Thin Wafer Market is benefiting from the growing interest in renewable energy solutions, particularly in solar energy applications. Thin wafers are increasingly utilized in photovoltaic cells, where their lightweight and efficient properties contribute to improved energy conversion rates. As the world shifts towards sustainable energy sources, the demand for solar panels is projected to rise significantly, with estimates indicating a market growth of over 20% annually. This trend underscores the importance of thin wafers in the renewable energy sector, as manufacturers seek to optimize performance while reducing material costs. The Thin Wafer Market is thus positioned to capitalize on this burgeoning demand for clean energy technologies.

Increased Investment in Research and Development

Increased investment in research and development is a driving force behind the Thin Wafer Market. As companies strive to innovate and enhance product offerings, substantial resources are being allocated to the development of new materials and processes. This focus on R&D is crucial for advancing the capabilities of thin wafers, enabling the production of devices with superior performance and efficiency. The semiconductor R&D expenditure is projected to exceed 70 billion dollars by 2025, reflecting the industry's commitment to innovation. Such investments are likely to yield breakthroughs that will further propel the Thin Wafer Market, as manufacturers seek to stay competitive in an ever-evolving technological landscape.

Technological Advancements in Semiconductor Fabrication

Technological innovations in semiconductor fabrication are playing a pivotal role in the Thin Wafer Market. Enhanced techniques such as atomic layer deposition and advanced lithography are enabling the production of thinner wafers with improved electrical properties. These advancements not only increase the efficiency of semiconductor devices but also reduce material waste, aligning with sustainability goals. The semiconductor industry is projected to reach a valuation exceeding 500 billion dollars by 2026, indicating a robust demand for thin wafers. As manufacturers adopt these cutting-edge technologies, the Thin Wafer Market is likely to witness accelerated growth, driven by the need for high-performance components in various applications.