Rising Water Scarcity Concerns

The US Automated Irrigation Market is increasingly shaped by the growing concerns surrounding water scarcity. As drought conditions become more prevalent in various regions, the need for efficient water management practices has never been more critical. Automated irrigation systems offer a viable solution by ensuring that water is applied precisely when and where it is needed, thereby minimizing waste. Recent studies indicate that regions such as California and the Southwest are experiencing significant water shortages, prompting farmers to adopt automated solutions to safeguard their crops. This heightened awareness of water scarcity is likely to drive demand for automated irrigation technologies, positioning the US Automated Irrigation Market for robust expansion.

Economic Viability and Cost Savings

The US Automated Irrigation Market is also driven by the economic viability of automated systems. Farmers are increasingly recognizing that investing in automated irrigation can lead to substantial cost savings over time. By optimizing water usage and reducing labor costs, these systems can enhance overall farm profitability. Data suggests that farms utilizing automated irrigation can reduce water usage by up to 30%, translating into significant financial savings. Additionally, the long-term benefits of improved crop yields and reduced resource waste make automated systems an attractive option for farmers. As economic pressures continue to mount, the US Automated Irrigation Market is likely to see increased adoption of these technologies as farmers seek to improve their bottom line.

Regulatory Framework and Incentives

The US Automated Irrigation Market is significantly influenced by the regulatory framework established by federal and state governments. Policies aimed at promoting sustainable agricultural practices are encouraging the adoption of automated irrigation systems. For instance, various states have implemented incentive programs that provide financial assistance to farmers who invest in water-efficient technologies. The USDA has also introduced initiatives that support research and development in irrigation technologies. These regulatory measures not only facilitate the transition to automated systems but also align with national goals of water conservation and sustainable agriculture. Consequently, the US Automated Irrigation Market is poised for growth as more farmers take advantage of these incentives.

Increased Focus on Sustainable Practices

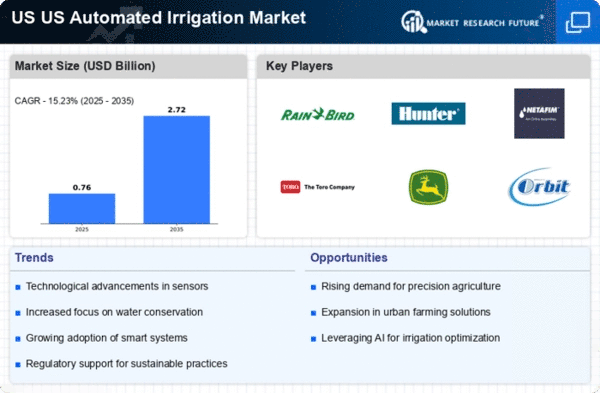

The US Automated Irrigation Market is witnessing a paradigm shift towards sustainability in agricultural practices. As consumers become more environmentally conscious, there is a growing demand for food produced using sustainable methods. Automated irrigation systems contribute to this trend by reducing water consumption and minimizing runoff. Furthermore, these systems can be integrated with renewable energy sources, further enhancing their sustainability profile. According to industry reports, the market for sustainable agricultural technologies is projected to grow at a compound annual growth rate of 15% over the next five years. This focus on sustainability is likely to propel the US Automated Irrigation Market forward as farmers seek to meet consumer expectations while adhering to environmental regulations.

Technological Integration in Agriculture

The US Automated Irrigation Market is experiencing a notable shift towards the integration of advanced technologies in agricultural practices. Innovations such as IoT-enabled sensors and smart controllers are enhancing the efficiency of irrigation systems. These technologies allow for real-time monitoring of soil moisture levels, weather conditions, and crop needs, thereby optimizing water usage. According to recent data, the adoption of precision agriculture techniques, which include automated irrigation, has increased by approximately 20% in the last five years. This trend suggests that farmers are increasingly recognizing the value of technology in improving crop yields while conserving water resources. As a result, the US Automated Irrigation Market is likely to see sustained growth driven by these technological advancements.