Advancements in Computational Biology

Advancements in computational biology are significantly influencing the drug discovery-informatics market. The ability to simulate biological processes and predict drug interactions through computational models has transformed the landscape of drug development. In the US, the market for computational biology is projected to grow at a CAGR of approximately 12% over the next five years. This growth is driven by the increasing complexity of biological systems and the need for sophisticated analytical tools. As researchers leverage these advancements, the drug discovery-informatics market is likely to expand, providing essential support for the development of novel therapeutics.

Increased Investment in Biotechnology

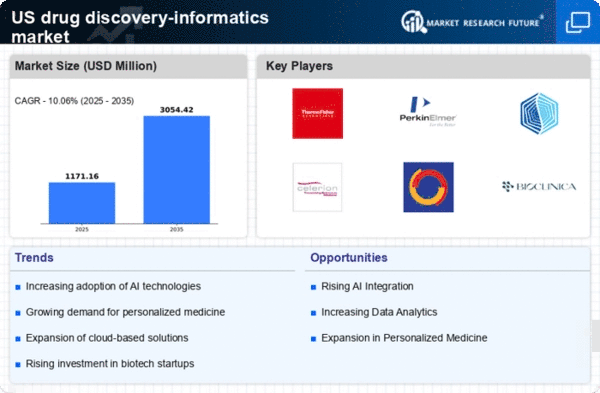

The drug discovery-informatics market is benefiting from increased investment in the biotechnology sector. Venture capital funding for biotech companies in the US has reached record levels, with investments surpassing $20 billion in recent years. This influx of capital is fostering innovation and driving the demand for informatics solutions that can support drug discovery efforts. As biotech firms seek to develop cutting-edge therapies, the need for robust data management and analysis tools becomes paramount. Consequently, the drug discovery-informatics market is poised for growth as these companies integrate informatics into their research and development processes.

Collaboration Between Academia and Industry

Collaboration between academia and industry is emerging as a key driver in the drug discovery-informatics market. Partnerships between universities and pharmaceutical companies are fostering innovation and accelerating the translation of research into practical applications. In the US, such collaborations have led to the establishment of numerous research consortia focused on drug discovery. These partnerships often leverage informatics tools to analyze complex datasets and share findings, enhancing the overall efficiency of the drug development process. As these collaborations continue to grow, the drug discovery-informatics market is likely to expand, driven by the collective expertise and resources of both sectors.

Rising Demand for Efficient Drug Development

The drug discovery-informatics market is experiencing a notable surge in demand for efficient drug development processes. As pharmaceutical companies strive to reduce the time and cost associated with bringing new drugs to market, the integration of informatics solutions becomes increasingly critical. In the US, the average cost of developing a new drug can exceed $2.6 billion, highlighting the need for innovative approaches. Informatics tools facilitate data management, analysis, and visualization, enabling researchers to make informed decisions more rapidly. This trend is likely to drive investments informatics technologies, as companies seek to streamline their workflows and enhance productivity in drug discovery.

Growing Emphasis on Data-Driven Decision Making

The growing emphasis on data-driven decision making is reshaping the drug discovery-informatics market. Pharmaceutical companies are increasingly recognizing the value of leveraging data analytics to inform their research strategies. In the US, the adoption of data analytics tools is projected to increase by over 30% in the next few years. This shift is driven by the need to enhance the accuracy of predictions regarding drug efficacy and safety. As organizations prioritize data-driven approaches, the demand for informatics solutions that can process and analyze large datasets will likely rise, further propelling the growth of the drug discovery-informatics market.