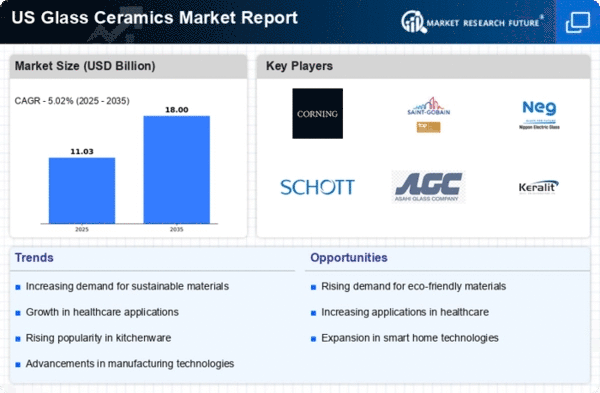

The glass ceramics market exhibits a dynamic competitive landscape characterized by innovation and strategic partnerships. Key players such as Corning Inc (US), Saint-Gobain (France), and Nippon Electric Glass Co Ltd (Japan) are at the forefront, leveraging their technological expertise and market presence to drive growth. Corning Inc (US) focuses on advanced materials and has recently emphasized sustainability in its product offerings, which aligns with the growing demand for eco-friendly solutions. Meanwhile, Saint-Gobain (France) is enhancing its operational capabilities through digital transformation initiatives, aiming to optimize production efficiency and reduce costs. Nippon Electric Glass Co Ltd (Japan) is also investing in R&D to develop high-performance glass ceramics, indicating a collective shift towards innovation as a key competitive driver.The market structure appears moderately fragmented, with several players vying for market share. Key business tactics include localizing manufacturing to reduce lead times and optimize supply chains. This strategy not only enhances responsiveness to market demands but also mitigates risks associated with global supply chain disruptions. The collective influence of these major players shapes a competitive environment where agility and technological advancement are paramount.

In September Corning Inc (US) announced a partnership with a leading automotive manufacturer to develop next-generation glass ceramics for electric vehicle applications. This strategic move underscores Corning's commitment to innovation and positions it favorably within the rapidly evolving automotive sector. The collaboration is expected to enhance the performance and durability of vehicle components, thereby reinforcing Corning's market leadership.

In August Saint-Gobain (France) unveiled a new production facility dedicated to the manufacturing of advanced glass ceramics in the US. This investment not only signifies Saint-Gobain's commitment to expanding its footprint in the North American market but also reflects a broader trend of regional manufacturing localization. The facility is anticipated to enhance supply chain efficiency and meet the increasing demand for high-performance materials in various industries.

In October Nippon Electric Glass Co Ltd (Japan) launched a new line of glass ceramics designed for high-temperature applications in the aerospace sector. This introduction highlights the company's focus on niche markets and its ability to cater to specialized needs. By diversifying its product offerings, Nippon Electric Glass Co Ltd (Japan) aims to capture a larger share of the high-value aerospace segment, which is expected to grow significantly in the coming years.

As of November current trends in the glass ceramics market are increasingly defined by digitalization, sustainability, and the integration of AI technologies. Strategic alliances among key players are shaping the competitive landscape, fostering innovation and enhancing product offerings. The shift from price-based competition to a focus on technological advancement and supply chain reliability is evident. Moving forward, companies that prioritize innovation and sustainability are likely to differentiate themselves in an increasingly competitive market.