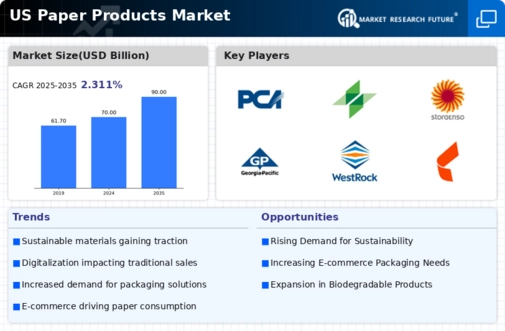

The US Paper Products Market is characterized by a highly competitive landscape, marked by a diverse range of players offering a variety of paper products including packaging materials, tissue papers, and specialty papers. The market dynamics are influenced by factors such as consumer demand for sustainable and environmentally-friendly products, technological advancements in manufacturing processes, and the ongoing shift towards e-commerce, which has increased the necessity for efficient packaging solutions. Companies are racing to innovate and align their offerings with changing consumer preferences and regulations regarding sustainability, fostering a climate of continuous development.

Understanding the competitive landscape is essential for assessing market opportunities, strategic positioning, and the overall viability of various players within this sector.Packaging Corporation of America stands out in the US Paper Products Market, recognized for its strong presence in the production of containerboard and corrugated packaging products. This company's strengths lie in its robust manufacturing capabilities and extensive distribution network, enabling it to meet diverse customer needs effectively. With a focus on quality and customer service, Packaging Corporation of America has established itself as a preferred supplier in the packaging sector.

Its investment in technology and sustainability practices underscores its commitment to producing environmentally responsible products, further enhancing its competitive edge in a market increasingly driven by eco-conscious consumers.Clearwater Paper also holds a notable position in the US Paper Products Market, specializing in the manufacture of high-quality tissue papers and bleached paperboard products. The company's key offerings include consumer tissue products, such as bathroom and facial tissues, along with a range of paperboard products tailored for packaging applications.

Clearwater Paper has leveraged strategic mergers and acquisitions to expand its market presence and diversify its product lines, which has contributed to its growth trajectory in the competitive landscape. The company's emphasis on operational efficiency, combined with a commitment to sustainability and innovation in product development, positions it favorably in responding to market demands. Clearwater Paper's dedicated focus on enhancing quality and minimizing environmental impact strengthens its brand reputation and customer loyalty in the US Paper Products Market.