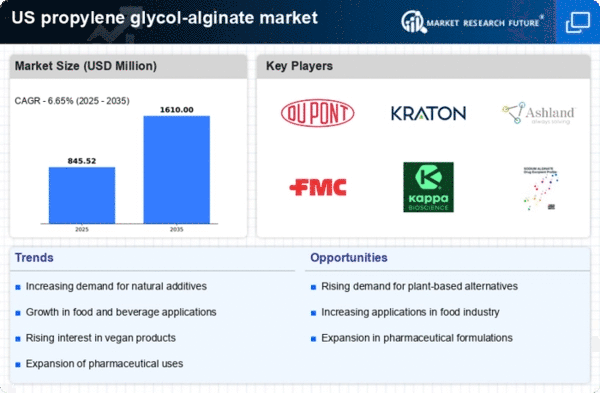

The propylene glycol-alginate market exhibits a dynamic competitive landscape characterized by innovation and strategic partnerships. Key players such as DuPont (US), Kraton Corporation (US), and Ashland Global Holdings Inc. (US) are actively shaping the market through various operational strategies. DuPont (US) focuses on enhancing its product portfolio by investing in research and development, aiming to introduce novel applications for propylene glycol-alginate in food and pharmaceuticals. Meanwhile, Kraton Corporation (US) emphasizes sustainability, integrating eco-friendly practices into its production processes, which aligns with the growing consumer demand for sustainable products. Ashland Global Holdings Inc. (US) is leveraging digital transformation to optimize its supply chain, thereby improving efficiency and responsiveness to market changes. Collectively, these strategies contribute to a competitive environment that prioritizes innovation and sustainability.The market structure appears moderately fragmented, with several players vying for market share. Key business tactics include localizing manufacturing to reduce costs and enhance supply chain resilience. Companies are increasingly focusing on optimizing their supply chains to mitigate risks and improve service delivery. This collective influence of major players fosters a competitive atmosphere where agility and responsiveness are paramount.

In October DuPont (US) announced a strategic partnership with a leading biotechnology firm to develop bio-based alternatives to traditional propylene glycol-alginate. This collaboration is poised to enhance DuPont's sustainability credentials while expanding its market reach. The strategic importance of this move lies in its potential to cater to the rising demand for environmentally friendly products, thereby positioning DuPont as a leader in sustainable innovation within the market.

In September Kraton Corporation (US) unveiled a new line of propylene glycol-alginate products designed specifically for the food industry, emphasizing clean label solutions. This launch reflects Kraton's commitment to meeting consumer preferences for transparency and health-conscious ingredients. The strategic significance of this initiative is underscored by the growing trend towards clean label products, which could enhance Kraton's competitive edge in the food sector.

In August Ashland Global Holdings Inc. (US) completed the acquisition of a regional competitor, which is expected to bolster its market presence and expand its product offerings. This acquisition is strategically important as it allows Ashland to leverage synergies in production and distribution, ultimately enhancing its competitive positioning in the propylene glycol-alginate market.

As of November current competitive trends indicate a strong emphasis on digitalization, sustainability, and the integration of AI technologies. Strategic alliances are increasingly shaping the landscape, enabling companies to pool resources and expertise. The shift from price-based competition to a focus on innovation, technology, and supply chain reliability is evident. Moving forward, competitive differentiation will likely hinge on the ability to innovate and adapt to evolving consumer preferences, with sustainability becoming a core component of strategic initiatives.