Expansion of Electric Vehicle Market

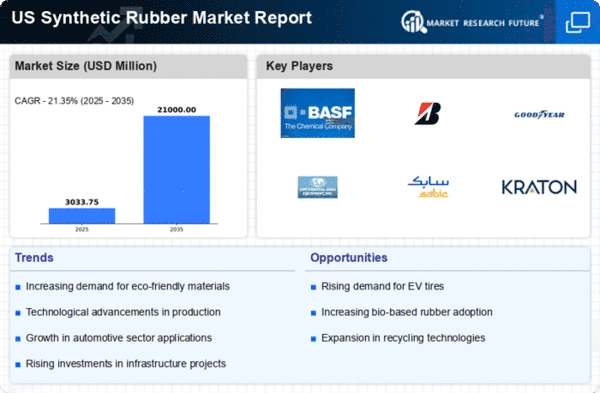

The synthetic rubber market is likely to benefit from the rapid expansion of the electric vehicle (EV) market in the US. As automakers increasingly focus on producing electric vehicles, the demand for lightweight and high-performance materials, including synthetic rubber, is expected to rise. Synthetic rubber is utilized in various components of EVs, such as tires, seals, and gaskets, which are essential for optimizing performance and energy efficiency. The US EV market is projected to grow at a CAGR of over 20% in the coming years, indicating a substantial opportunity for synthetic rubber manufacturers. This shift towards electrification in the automotive sector may drive innovation and investment in synthetic rubber technologies, further enhancing the market's growth prospects.

Increasing Demand for High-Performance Tires

The synthetic rubber market is experiencing a notable surge in demand for high-performance tires, driven by the automotive industry's shift towards enhanced safety and fuel efficiency. In the US, the tire segment accounts for a substantial portion of synthetic rubber consumption, with estimates suggesting that it constitutes around 60% of the total market. This trend is further fueled by consumer preferences for vehicles that offer superior handling and durability. As manufacturers innovate to meet these demands, the synthetic rubber market is likely to see increased production capacities and technological advancements in rubber formulations. The emphasis on performance characteristics is expected to propel the market forward, as companies invest in research and development to create materials that can withstand extreme conditions while maintaining flexibility and resilience.

Technological Innovations in Production Processes

The synthetic rubber market is experiencing a wave of technological innovations that are transforming production processes. Advances in polymerization techniques and the development of more efficient manufacturing methods are enabling producers to create synthetic rubber with enhanced properties and lower environmental impact. These innovations are crucial as the industry faces increasing pressure to reduce carbon footprints and improve sustainability. The implementation of automation and digital technologies in production facilities is also streamlining operations, potentially leading to cost reductions and improved product quality. As these technologies continue to evolve, the synthetic rubber market is likely to see a shift towards more sustainable practices, which may attract investment and drive growth in the coming years.

Growth in Construction and Infrastructure Projects

The synthetic rubber market is poised for growth due to the expansion of construction and infrastructure projects across the US. With government initiatives aimed at improving transportation networks and urban development, the demand for synthetic rubber in applications such as sealants, adhesives, and flooring materials is on the rise. The construction sector is projected to grow at a CAGR of approximately 5% over the next few years, which will likely drive the consumption of synthetic rubber products. This growth is indicative of a broader trend towards modernization and sustainability in building practices, where synthetic rubber materials are favored for their durability and performance. As infrastructure investments increase, the synthetic rubber market is expected to benefit significantly from this upward trajectory.

Rising Adoption of Synthetic Rubber in Medical Applications

The synthetic rubber market is witnessing a growing adoption in medical applications, particularly in the production of medical devices and personal protective equipment (PPE). The versatility of synthetic rubber allows for the creation of materials that are both durable and biocompatible, making them suitable for various healthcare products. The US medical device market is projected to reach $208 billion by 2025, which may lead to increased demand for synthetic rubber components. This trend reflects a broader shift towards innovation in healthcare, where synthetic rubber plays a crucial role in ensuring safety and efficacy. As the healthcare sector continues to evolve, the synthetic rubber market is likely to expand its footprint in this vital industry.