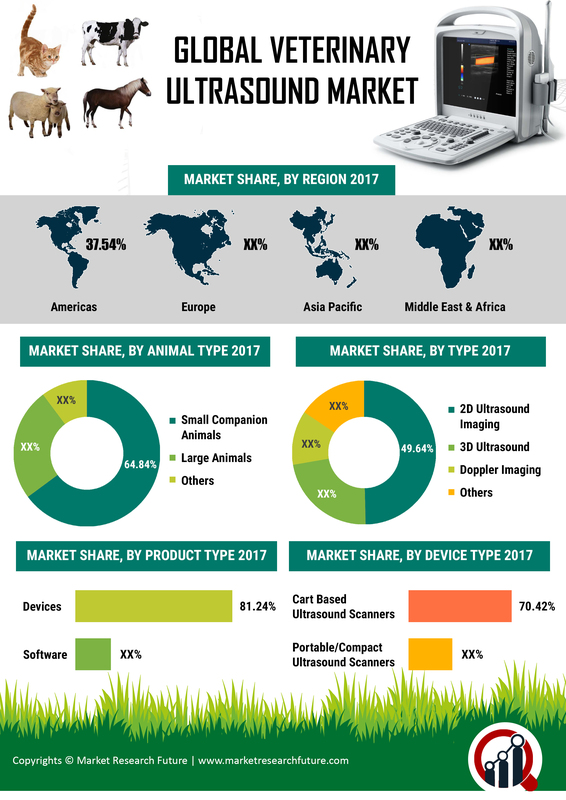

Rising Pet Ownership Trends

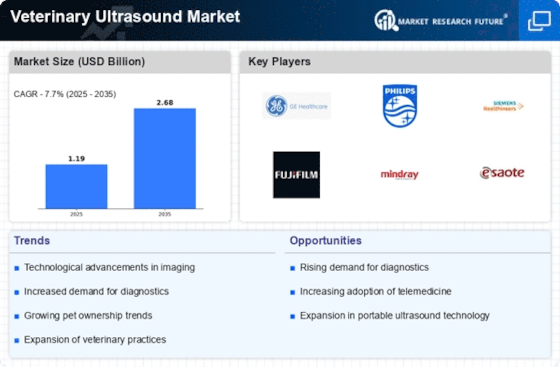

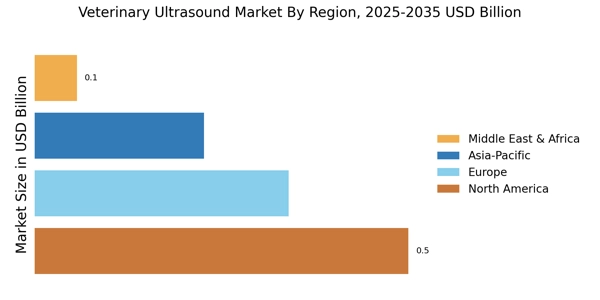

The Veterinary Ultrasound Market is significantly influenced by the rising trends in pet ownership. As more households adopt pets, the demand for veterinary services, including ultrasound diagnostics, is on the rise. Recent statistics indicate that pet ownership has increased by approximately 20% over the last decade, leading to a corresponding increase in the need for advanced veterinary care. This trend is particularly pronounced in urban areas, where pet owners are more likely to seek specialized veterinary services. Consequently, the Veterinary Ultrasound Market is poised for growth as veterinarians expand their diagnostic capabilities to cater to a larger pet population. The increasing awareness of pet health and wellness further propels this demand, suggesting a robust future for veterinary ultrasound technologies.

Growing Awareness of Animal Health

The Veterinary Ultrasound Market is benefiting from a growing awareness of animal health among pet owners. As individuals become more informed about the importance of regular veterinary check-ups and early disease detection, the demand for diagnostic tools such as ultrasound is increasing. Educational campaigns and outreach programs have played a crucial role in promoting the significance of preventive care, which includes the use of ultrasound for non-invasive diagnostics. This heightened awareness is likely to drive the Veterinary Ultrasound Market forward, as more pet owners seek advanced diagnostic options to ensure their animals' well-being. The trend suggests a shift towards proactive health management, which could further stimulate the market for veterinary ultrasound technologies.

Increased Investment in Veterinary Healthcare

The Veterinary Ultrasound Market is witnessing increased investment in veterinary healthcare, which is a key driver of market growth. As veterinary practices expand and modernize, there is a growing need for advanced diagnostic equipment, including ultrasound machines. Investment in veterinary healthcare has been on the rise, with estimates indicating a growth rate of around 10% annually in veterinary spending. This trend reflects a broader recognition of the value of animal health and the importance of high-quality veterinary services. As practices invest in state-of-the-art ultrasound technology, the Veterinary Ultrasound Market is likely to experience significant advancements in diagnostic capabilities. This influx of capital not only enhances the quality of care but also encourages innovation within the industry.

Integration of Telemedicine in Veterinary Practices

The integration of telemedicine into veterinary practices is reshaping the Veterinary Ultrasound Market. This trend allows veterinarians to conduct remote consultations and share ultrasound images with specialists, enhancing diagnostic accuracy and treatment planning. The convenience of telemedicine is appealing to pet owners, as it reduces the need for in-person visits while still providing access to high-quality veterinary care. As telemedicine becomes more prevalent, the demand for veterinary ultrasound equipment that can easily interface with digital platforms is likely to increase. This shift not only improves access to veterinary services but also encourages the adoption of advanced ultrasound technologies, thereby driving growth in the Veterinary Ultrasound Market. The potential for remote diagnostics may lead to a more efficient use of resources in veterinary practices.

Technological Advancements in Veterinary Ultrasound

The Veterinary Ultrasound Market is experiencing a notable transformation due to rapid technological advancements. Innovations such as portable ultrasound devices and advanced imaging techniques are enhancing diagnostic capabilities. These developments allow veterinarians to perform more accurate assessments of animal health, leading to improved treatment outcomes. The market for veterinary ultrasound equipment is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 8% in the coming years. This growth is driven by the increasing demand for non-invasive diagnostic tools that provide real-time imaging. As technology continues to evolve, the Veterinary Ultrasound Market is likely to see further enhancements in image quality and ease of use, making these tools indispensable in veterinary practices.