Market Share

Warehouse Robotics Market Share Analysis

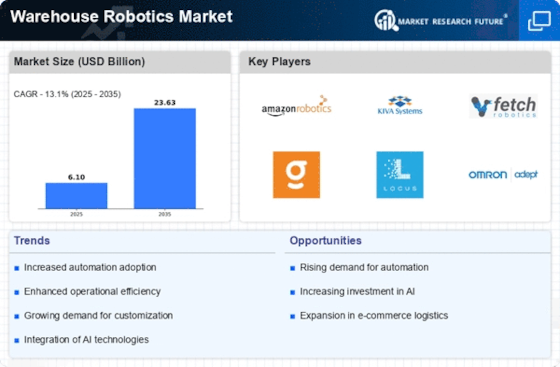

With the rapid growth of the warehouse robotics market, there are a lot of different strategies for sharing out the market share. Differentiation is a common strategy, in which companies attempt to create a special market niche with unique features and high technology for their robotic applications. Following this path means that businesses can differentiate themselves from competitors, target specific client groups and become dominant in each use case within the overall warehouse robotics frontier. Another important strategy adopted by companies in the warehouse robotics market is competitive pricing. Because implementing robotic systems requires such a large initial investment in capital, companies frequently envision ways to keep their solutions cheaper--to reduce costs. It not only means reducing the initial investment, but also by considering the total cost of ownership throughout their lifetime. Offering such low-cost, high-performance solutions can give a firm an edge over its competitors and lock up a big stretch of the market. A market share positioning strategy is more and more frequently realized through collaborative partnerships and strategic alliances. Corporations soon realize the importance of complementing their own strengths by those of others in the ecosystem, and this has become a win-win story for everyone involved. For example, companies may need to form alliances with providers of technology; integrators; or even end-users. Only in this way can firms provide comprehensive and customized products to resolve specific problems within the supply chain and logistics industry. Collaborative approaches, on the other hand, can expand market share and speed up innovation while giving a more integrated response to customers 'needs. Such strategies also heavily rely on R&D. To stay in front of the pack, companies invest in continuous innovation. They add new features, capabilities, and improvements to their robotic systems. Looking at R & D from this perspective, not only will companies improve the performance and efficiency of existing products but they also have the potential to create cutting edge technology that in turn becomes industry standard. With such a capability, these companies would become an Eagle promoting its technological prowess within the warehouse robotics market. It is widely understood that adopting a customer-centered approach has become a strategic imperative. By understanding customers' special needs and pain points, a company can adjust their solutions accordingly. This entails in-depth and professional services, customization options and long-term contact to ensure customer satisfaction. Besides generating repeat business, satisfied customers can also serve as positive references to potential future buyers.

Leave a Comment