Market Trends

Key Emerging Trends in the Warehouse Robotics Market

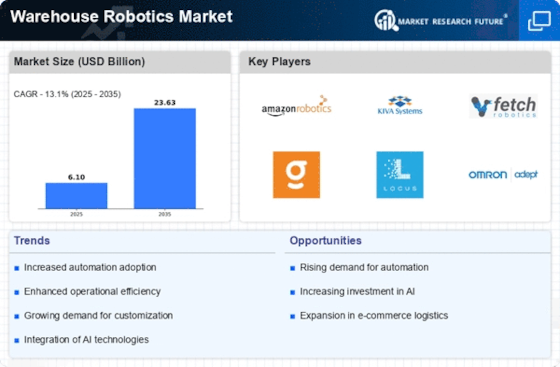

The world of logistics and supply chain operations is undergoing rapid transformation at several levels of warehouse robotics. An especially important trend is the development of modular and expandable robotic systems. Most companies want flexible solutions that can be fitted into extant warehouse infrastructures and expanded or contracted as demand changes. From a flexible point of view, modular robotic systems enable companies to design solutions targeted for specific needs. This suits them well to today's changing supply chain needs. Collaborative robotics, in which humans and robots work together in the same space is also gaining popularity. The move away from fully automated systems is also one that requires human control over decision-making because the robots are precise and effective. Cobots, or collaborative robots can help raise productivity. In addition, they are more secure than the traditional industrial robot and create a friendlier environment in which man and machine can live and work together. Another major trend is the application of artificial intelligence (AI) and machine learning (ML) to warehouse robotics. Robots use advanced algorithms to learn from experience, adjust themselves to changing environments, and improve their operations over time. For example, robots equipped with artificial intelligence can make intelligent judgments like the reasonable allocation of picking routes and even making reservations for maintenance in advance to avoid unexpected breakdowns. They not only facilitate increased production but also reduce downtime. Meanwhile, micro-fulfillment centers are chiefly driving a transformation of the warehouse robotics market. Given the increasing need to fill orders faster and closer to home, businesses are going hog wild for smaller, fully automated fulfillment centers located in urban environments. These micro-fulfillment centers are equipped with warehouse robotics to help them quickly store and deliver high velocity, small batches of shipping. As consumer demand for quicker more convenient home delivery is increasing, these centers provide both an opportunity and a challenge to traditional distribution channels.

Leave a Comment