Wine Size

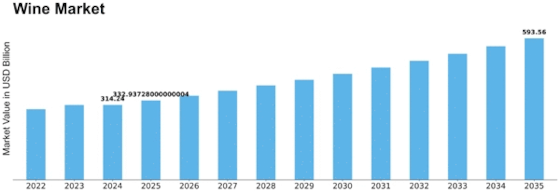

Wine Market Growth Projections and Opportunities

The Wine Market is influenced by different elements that add to its dynamics and development. Shopper inclinations and developing preferences assume a focal part in forming this market. As shoppers become more adventurous and look for interesting flavor profiles, there is a developing demand for diverse sorts of wine, including varietals, blends, and even normal or natural choices. This changing landscape has led to an increased spotlight on development by winemakers, who constantly endeavor to make wines that take care of the advancing sense of taste of customers. Wine utilization is often linked to financial conditions, with customer spending on wine influenced by disposable pay levels. During periods of financial thriving, customers might be more inclined to buy premium and extravagance wines, while monetary downturns might see a shift towards more budget-friendly choices. The wine industry is receptive to these financial vacillations, and wineries should adjust their marketing procedures and product offerings accordingly. Wine is produced in different locales around the world, each known for its remarkable terroir and grape assortments. Global trade, monetary developments, and international occasions can influence the accessibility and valuing of wines. Changes in taxes and trade arrangements can likewise impact the worldwide development of wine, influencing the seriousness of wineries in different districts. Adapting to these worldwide variables is essential for wineries looking to lay out a presence in the global marketplace. Social and way of life factors contribute fundamentally to the dynamics of the Wine Market. Wine has social importance in numerous social orders and is often associated with festivities, and culinary meetings. As ways of life change, with a rising spotlight on dining encounters and get-togethers, there is a developing demand for wines that supplement diverse foods and events. Winemakers and marketers need to understand and adapt to these social movements to position their products in the market.

Leave a Comment