衛星通信市場 概要

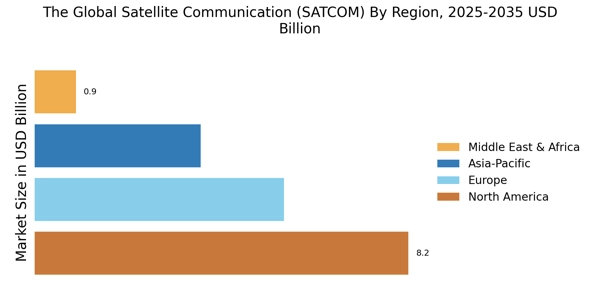

MRFRの分析によると、2024年のグローバル衛星通信市場(SATCOM)の規模は182.2億米ドルと推定されています。SATCOM業界は、2025年に197.6億米ドルから2035年には444.2億米ドルに成長すると予測されており、2025年から2035年の予測期間中に年平均成長率(CAGR)は8.44を示します。

主要な市場動向とハイライト

グローバル衛星通信市場(SATCOM)は、技術の進歩とさまざまな分野での需要の増加により、 substantial growthが見込まれています。

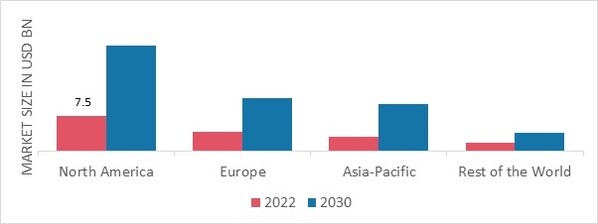

- 低軌道衛星の出現は、特に北米においてSATCOMの風景を再形成しています。アジア太平洋地域では、SATCOMと新興技術の統合が市場の拡大を加速させており、特にトランシーバーセグメントにおいて顕著です。衛星通信におけるセキュリティとレジリエンスへの注目が、政府および商業アプリケーションの両方でますます重要になっています。高速インターネットの需要の高まりとIoTおよびM2M通信の採用の増加が、市場を前進させる主要な要因となっています。

市場規模と予測

| 2024 Market Size | 182.2億ドル |

| 2035 Market Size | 44.42 (米ドル十億) |

| CAGR (2025 - 2035) | 8.44% |

主要なプレーヤー

スペースX(米国)、SES S.A.(ルクセンブルク)、インテルサットS.A.(米国)、ユーテルサット・コミュニケーションズ(フランス)、インマルサット・グローバル・リミテッド(イギリス)、テレサット・カナダ(カナダ)、ヒューズ・ネットワーク・システムズ(米国)、イリジウム・コミュニケーションズ社(米国)、ワンウェブ(イギリス)

出典:二次研究、一次研究、Market Research Futureデータベースおよびアナリストレビュー

出典:二次研究、一次研究、Market Research Futureデータベースおよびアナリストレビュー