Research methodology on Automotive Electric Bus Market

1. Introduction

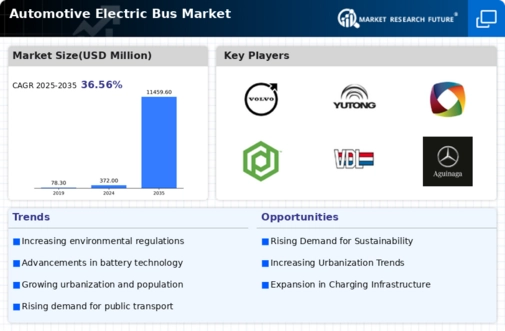

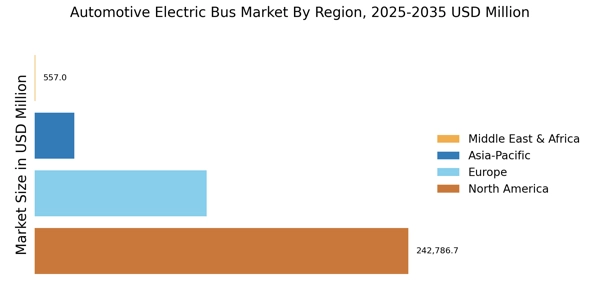

The purpose of this research methodology is to provide a consistent, reliable and valid method for the analysis of the Automotive Electric Bus Market report produced by Market Research Future (MRF). This report covers the current market size and potential opportunities in the future. This research methodology is used to support the conclusions obtained and is the basis for the comparison of trends, drivers and restraints in the industry, as well as regional comparisons.

2. Research Proposal and Design

To analyze the Automotive Electric Bus Market report produced by MRFR, a research proposal and design are implemented to provide comprehensive information on the market. The research methodology is designed to account for the qualitative and quantitative data, as well as both primary and secondary sources, necessary to analyze the market. The research proposal includes the following steps:

- A comprehensive literature review of the Automotive Electric Bus Market.

- Market size assessment and an understanding of the competitive landscape.

Market segmentation

- Identification of the industry’s drivers, restraints, and opportunities

- Establishment of key industry trends

- Gathering and analyzing secondary sources relating to the market

- Developing and utilizing data mining techniques for quantitative analysis

- Interviewing industry experts for qualitative insights

- Validation of collected data

3. Data Collection

The data collection process for this research methodology relied heavily on primary and secondary sources. Primary sources include interviews with key players in the industry and expert opinions, while secondary sources include industry reports, research papers and surveys.

A. Primary Data

One of the primary sources of data gathering is interviews with industry experts, such as Automotive Electric Bus (AEB) industry experts, OEMs and suppliers. Interviews consisted of both structured and semi-structured formats, conducted through phone and in-person interviews. Interviews are conducted to gain a deeper understanding of the industry, potential challenges faced by market trends, and growth opportunities.

B. Secondary Data

Industry reports, white papers, research publications, surveys, and news articles concerning the Automotive Electric Bus market are major secondary sources of data. As part of the research, numerous secondary sources are procured and reviewed to develop the data needed for the report's analysis.

4. Sampling Methods

The sampling method used for this research is a nonprobability sampling method. Due to limited resources, the sample size is small, allowing for the collection of data from an industry expert panel through interviews.

5. Data Analysis

Quantitative analysis is used for the analysis of the data collected. Statistical analysis is conducted by analyzing the data against industry norms, historical trends and other lagging indicators of relevance to the Automotive Electric Bus industry.

6. Ethical Considerations

Ethical consideration is taken into account during the research process, as all research projects must ensure that participant confidentiality and data accuracy are maintained. Furthermore, proper regulations, laws and guidelines applicable to the industry and research process are followed.

7. Conclusion

As a result of our research methodology, it can provide a comprehensive assessment of the Automotive Electric Bus Market. This research has produced a detailed understanding of the market trends, drivers, restraints and opportunities. The data collected through the research process is validated and analyzed for the final report. The results of this research are used to produce valuable insights and provide an accurate overview of the industry.