Research Methodology on Broadcast Equipment Market

1 Introduction:

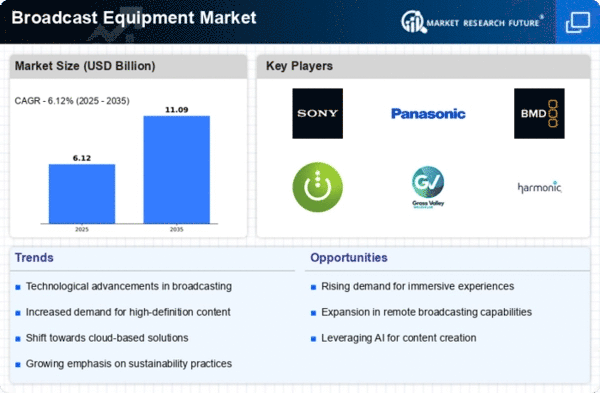

This research methodology is intended to be used to develop a research report on the global broadcast equipment market. Market research is a systematic process of collecting, analyzing, and interpreting information to understand and acquire a better knowledge of the market conditions, trends, and industrial dynamics of the broadcast equipment market. This research methodology provides an overview of the research design for the collection and analysis of data for the global broadcast equipment market. It provides information about the research question, data sources, objectives, and sample size.

2 Research Question:

What are the current market trends and growth opportunities for the global broadcast equipment market?

3 Objective:

The objective of this research report is to study the market dynamics of the global broadcast equipment market and provide insights on the following:

- To study the current market trends of the global broadcast equipment market

- To analyze the growth opportunities and challenges in the global broadcast equipment market

- To identify the factors impacting the growth of the global broadcast equipment market

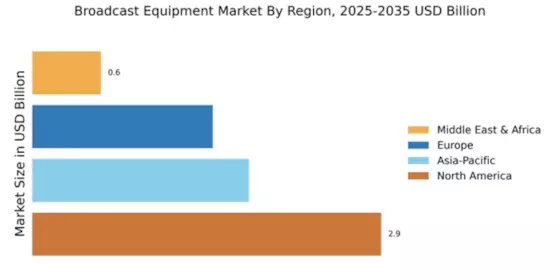

- To analyze the segment-wise market dynamics of the global broadcast equipment market

- To study the key performance indicators (KPIs) of the global broadcast equipment market

- To identify the major players and analyze their strategies in the global broadcast equipment market

4 Data Sources and Analysis Methodology:

The research methodology includes both primary and secondary data sources. Primary data sources include interviews with industry experts, senior managers, and key opinion leaders across 18 countries through the market research survey. The interviews provide insights into the perceptual view of the market while secondary data sources provide factual or quantitative data from publicly available resources.

Secondary data sources include industry journals, trade magazines, Google Scholar, and other relevant documents. Statistical data sources such as Factiva, Bloomberg, and Gartner are also used to gain an understanding of the market size and understanding the dynamics of the broadcast equipment market. The research methodology also includes the use of Porter’s five forces model, the SWOT analysis and competitive landscape analysis to understand the competitive environment of the broadcast equipment market.

5 Sample Size:

The market research survey consists of 48 respondents from 18 countries across five regions. These countries include the United States, Canada, Germany, Japan, South Korea, China, Taiwan, India, South Africa, Brazil, Peru, Mexico, Central and South America, the Middle East, and North Africa.

6 Data Analysis:

The data collected from both primary and secondary sources are analyzed using qualitative and quantitative approaches for a better understanding of the market dynamics. The qualitative analysis focuses on the market trend analysis and Porter’s five forces analysis. The quantitative analysis focuses on the market size, market share, and revenue analysis of the broadcast equipment market. The data is further analyzed using analytical tools such as SPSS, Microsoft Excel, and Tableau.