Rising Cybersecurity Threats

The Encryption Software Market is experiencing a surge in demand due to the escalating frequency and sophistication of cyber threats. Organizations are increasingly recognizing the necessity of robust encryption solutions to safeguard sensitive data from unauthorized access and breaches. In 2025, it is estimated that cybercrime will cost businesses over 10 trillion dollars annually, underscoring the urgency for effective encryption measures. As data breaches continue to make headlines, the need for encryption software becomes paramount, driving investments in this sector. Companies are prioritizing encryption not only to protect their assets but also to maintain customer trust and comply with stringent data protection regulations. This trend indicates a growing awareness of the importance of encryption in the overall cybersecurity strategy, positioning the Encryption Software Market for substantial growth in the coming years.

Increased Regulatory Compliance

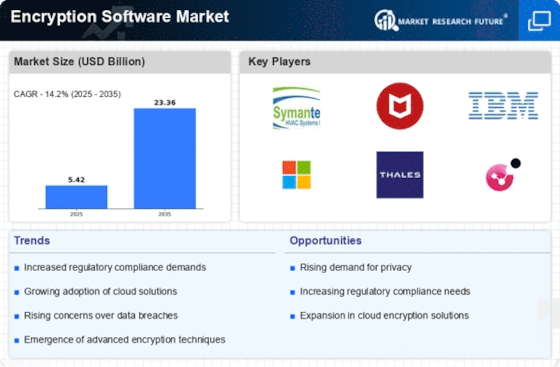

The Encryption Software Market is significantly influenced by the tightening of regulatory frameworks surrounding data protection and privacy. Governments and regulatory bodies are implementing stringent laws that mandate the use of encryption to protect sensitive information. For instance, regulations such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) require organizations to adopt encryption measures to ensure compliance. As businesses strive to avoid hefty fines and reputational damage, the demand for encryption software is expected to rise. In 2025, the market is projected to grow at a compound annual growth rate (CAGR) of over 15%, driven by the need for compliance with these regulations. This trend highlights the critical role of encryption in not only protecting data but also in fulfilling legal obligations, thereby propelling the Encryption Software Market forward.

Growing Awareness of Data Privacy

The Encryption Software Market is experiencing growth driven by an increasing awareness of data privacy among consumers and businesses alike. As individuals become more conscious of their digital footprints and the potential misuse of their personal information, the demand for encryption solutions is rising. Organizations are recognizing that implementing encryption is not just a technical requirement but a critical component of their brand reputation and customer trust. In 2025, surveys indicate that over 70% of consumers are likely to choose companies that prioritize data protection, further emphasizing the importance of encryption. This heightened awareness is prompting businesses to invest in encryption software to enhance their data protection strategies. Consequently, the Encryption Software Market is poised for expansion as organizations strive to meet consumer expectations and regulatory demands regarding data privacy.

Integration with Emerging Technologies

The Encryption Software Market is being propelled by the integration of encryption solutions with emerging technologies such as cloud computing, Internet of Things (IoT), and artificial intelligence (AI). As these technologies become more prevalent, the need for secure data transmission and storage is paramount. For instance, the rise of IoT devices has led to an exponential increase in data generation, necessitating robust encryption to protect this information. In 2025, the market for encryption in cloud services is projected to grow significantly, as businesses migrate to cloud-based solutions and require encryption to safeguard their data. This integration not only enhances security but also fosters innovation, as organizations leverage encryption to enable secure transactions and communications. The convergence of encryption with these technologies indicates a dynamic shift in the Encryption Software Market, driving growth and adoption across various sectors.

Adoption of Advanced Encryption Technologies

The Encryption Software Market is witnessing a transformative shift with the adoption of advanced encryption technologies such as quantum encryption and homomorphic encryption. These innovative solutions offer enhanced security features that traditional encryption methods cannot provide. As organizations seek to protect their data against emerging threats, the integration of these advanced technologies is becoming increasingly prevalent. In 2025, the market for quantum encryption alone is expected to reach several billion dollars, reflecting a growing investment in cutting-edge encryption solutions. This trend suggests that businesses are not only looking for basic encryption but are also willing to invest in sophisticated technologies that offer superior protection. The ongoing evolution of encryption technologies is likely to drive the Encryption Software Market to new heights, as organizations prioritize security in an increasingly digital landscape.

Leave a Comment