Market Trends

Key Emerging Trends in the Encryption Software Market

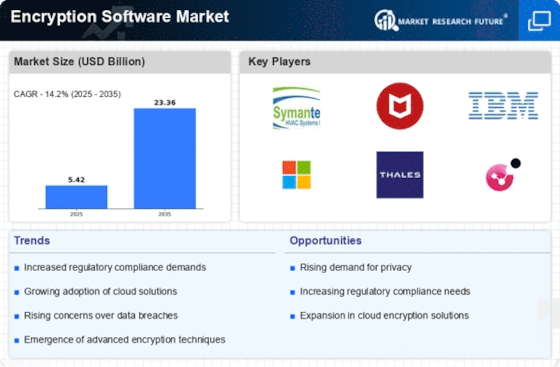

Recently, the Encryption Software Market witnessed significant growth and development driven by concerns over information security and privacy. As both individuals and entities struggle with the increasing frequency and sophistication of internet-based threats, demand for strong encryption solutions has skyrocketed. Amongst other noticeable trends in this market is the widespread adoption of encryption software across various industries (Rouse & Partners 6). Another notable trend is the growing prevalence of cloud-based systems offering data protection through encrypting it. As more companies move into cloud environments, there has been increased demand for encryption software that can be easily integrated into these platforms. Additionally, cloud-based encryption also provides flexible and scalable answers while dealing with changing digital risks in the digital landscape. This shift towards cloud-driven encryption solutions indicates a business's ability to adapt to changing technology landscapes as well as the increasingly important value of securing data in cloud environments. Moreover, E2EE uptake is occurring widely within the Encryption Software Market. Since more people are using digital means to communicate, sensitive information must be secured during transit. Accordingly, E2E ensures that from sources up to destinations, the messages remain private, thus providing strong protection against potential online vulnerabilities. The market is also undergoing diversification in terms of encrypted methods and algorithms used. Therefore, encryption providers are developing advanced methods that will ensure they stay ahead of potential weaknesses due to the complexity with respect to cybercrime. One such is quantum-safe encryption, whose popularity has been rising over the years because of the potential threat that quantum computing poses to conventional encryption techniques. Moreover, the Encryption Software Market is witnessing increased convergence with emerging technologies such as artificial intelligence (AI) and machine learning (ML). These technologies enhance the capabilities of encryption solutions by providing proactive threat detection and response mechanisms. On a regulatory front, strict data protection laws and compliance requirements are driving the adoption of encryption software. Governments and regulatory bodies across the world are mandating the implementation of robust information security measures to protect individual privacy. As firms aim to adhere to these guidelines, there is increasing demand for encryption solutions that satisfy set standards.

Leave a Comment