Regulatory Changes

Regulatory changes are a critical driver in the hair care market in Europe. The European Union has implemented stringent regulations regarding cosmetic products, focusing on safety and ingredient transparency. These regulations require brands to disclose all ingredients and ensure that products meet safety standards. Compliance with these regulations is essential for market entry and consumer trust. As a result, companies are investing in research and development to formulate products that not only comply with regulations but also appeal to health-conscious consumers. The hair care market is thus navigating a complex regulatory landscape, which may pose challenges but also encourages innovation and higher product quality.

Influence of Social Media

The influence of social media is profoundly impacting the hair care market in Europe. Platforms such as Instagram and TikTok are becoming vital channels for brand promotion and consumer engagement. Influencers and beauty enthusiasts are sharing product reviews and tutorials, which significantly shape consumer purchasing decisions. Recent studies suggest that nearly 70% of consumers are influenced by social media when selecting hair care products. This trend has led brands to invest in social media marketing strategies, collaborating with influencers to reach wider audiences. As the hair care market continues to embrace digital platforms, the importance of social media in driving brand awareness and sales is likely to grow, creating new opportunities for engagement and customer loyalty.

Sustainability Initiatives

The hair care market in Europe is increasingly influenced by sustainability initiatives. Consumers are becoming more environmentally conscious, leading to a demand for eco-friendly products. Brands are responding by reformulating products to include biodegradable ingredients and recyclable packaging. According to recent data, approximately 60% of European consumers express a preference for sustainable brands. This shift not only aligns with consumer values but also enhances brand loyalty. Companies that adopt sustainable practices may experience a competitive advantage, as they appeal to a growing demographic that prioritizes environmental responsibility. The hair care market is thus witnessing a transformation, where sustainability is not merely a trend but a fundamental aspect of product development and marketing strategies.

Technological Advancements

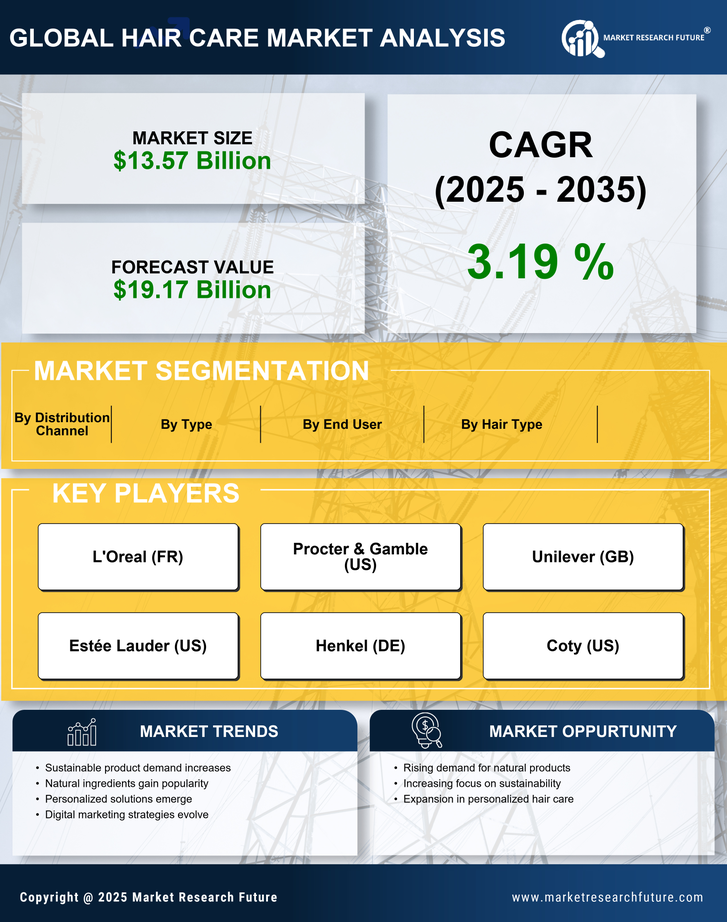

Technological advancements are reshaping the hair care market in Europe. Innovations in product formulation and manufacturing processes are enabling brands to create more effective and targeted solutions. For instance, the integration of artificial intelligence in product recommendations is enhancing personalization, allowing consumers to find products that suit their specific hair types and concerns. Furthermore, advancements in delivery systems, such as microencapsulation, are improving the efficacy of active ingredients. The market is projected to grow at a CAGR of 5.2% over the next five years, driven by these technological innovations. As brands leverage technology to enhance product performance, the hair care market is likely to see increased consumer engagement and satisfaction.

Changing Consumer Preferences

Changing consumer preferences are a significant driver in the hair care market in Europe. There is a noticeable shift towards products that cater to diverse hair types and textures, reflecting the multicultural landscape of European society. Consumers are increasingly seeking products that address specific needs, such as frizz control, moisture retention, and scalp health. This trend is supported by market data indicating that niche brands focusing on specialized hair care solutions are gaining traction, capturing a larger market share. As a result, established brands are reformulating their offerings to include a wider range of products. This evolution in consumer preferences is prompting the hair care market to adapt and innovate, ensuring that it meets the demands of a diverse customer base.