Energy Efficiency Regulations

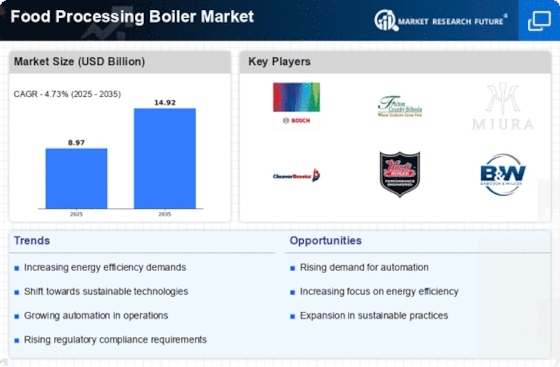

Stringent energy efficiency regulations are shaping the Food Processing Boiler Market. Governments worldwide are implementing policies aimed at reducing energy consumption and greenhouse gas emissions. These regulations compel food processing companies to adopt more energy-efficient boiler systems. For instance, the implementation of the Energy Star program has led to a significant increase in the adoption of high-efficiency boilers. The Food Processing Boiler Market is expected to see a shift towards technologies that not only comply with these regulations but also offer cost savings in the long run. This trend indicates a growing market for innovative boiler solutions that align with sustainability goals.

Rising Demand for Processed Foods

The increasing demand for processed foods is a primary driver of the Food Processing Boiler Market. As consumer preferences shift towards convenience and ready-to-eat meals, food manufacturers are compelled to enhance their production capabilities. This trend is reflected in the projected growth of the processed food sector, which is expected to reach a valuation of over 3 trillion USD by 2025. Consequently, food processing facilities are investing in advanced boiler systems to meet the rising production demands efficiently. The Food Processing Boiler Market is likely to benefit from this surge, as boilers play a crucial role in maintaining the quality and safety of processed food products.

Growing Focus on Food Safety Standards

The growing focus on food safety standards is a significant driver for the Food Processing Boiler Market. Regulatory bodies are enforcing stricter guidelines to ensure the safety and quality of food products. As a result, food processing companies are investing in advanced boiler systems that comply with these standards. The need for consistent temperature control and steam quality in food processing applications necessitates the use of high-quality boilers. This trend is likely to propel the demand for reliable and efficient boiler systems, as manufacturers seek to avoid costly recalls and maintain consumer trust in their products. The Food Processing Boiler Market is poised for growth as companies prioritize compliance with food safety regulations.

Expansion of Food Processing Facilities

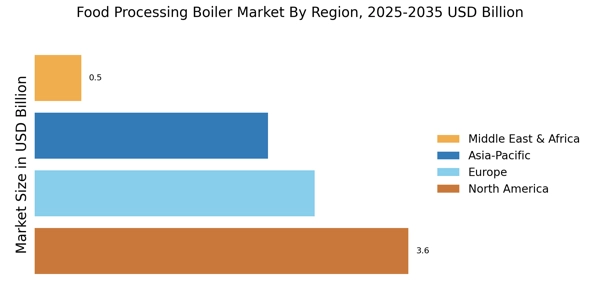

The expansion of food processing facilities is driving growth in the Food Processing Boiler Market. As the global population continues to rise, the demand for food products is increasing, prompting manufacturers to scale up their operations. New food processing plants are being established, particularly in emerging markets, which creates a substantial demand for boiler systems. According to industry reports, the food processing sector is expected to grow at a CAGR of 5% over the next five years. This expansion necessitates the installation of efficient boiler systems to support increased production capacities. The Food Processing Boiler Market is likely to experience robust growth as a result of this trend.

Technological Innovations in Boiler Design

Technological innovations in boiler design are transforming the Food Processing Boiler Market. Advances in automation, control systems, and materials science are leading to the development of more efficient and reliable boiler systems. For example, the integration of IoT technology allows for real-time monitoring and optimization of boiler performance, which can enhance operational efficiency. The market is witnessing a shift towards modular and compact boiler designs that cater to the specific needs of food processing facilities. This trend not only improves energy efficiency but also reduces the overall footprint of boiler systems, making them more appealing to manufacturers in the Food Processing Boiler Market.