Advancements in Sensor Technology

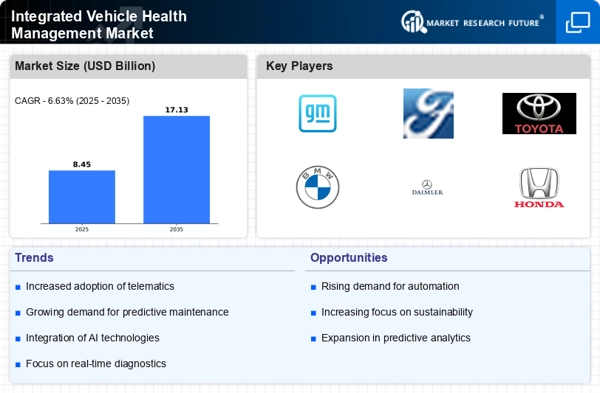

The Integrated Vehicle Health Management Market is experiencing a notable surge due to advancements in sensor technology. These innovations enable real-time monitoring of vehicle components, enhancing the ability to detect anomalies before they escalate into significant issues. For instance, the integration of IoT sensors allows for continuous data collection, which can lead to predictive maintenance strategies. This proactive approach not only reduces downtime but also extends the lifespan of vehicle components. As a result, the market is projected to grow at a compound annual growth rate of approximately 10% over the next five years, driven by the increasing demand for efficient vehicle management solutions.

Regulatory Compliance and Safety Standards

The Integrated Vehicle Health Management Market is significantly influenced by stringent regulatory compliance and safety standards. Governments worldwide are implementing regulations that mandate the use of advanced vehicle health monitoring systems to ensure safety and reduce emissions. This regulatory landscape compels manufacturers to adopt integrated health management solutions that comply with these standards. Consequently, the market is likely to witness a robust growth trajectory as companies invest in technologies that not only meet regulatory requirements but also enhance vehicle performance. The increasing focus on safety and environmental sustainability is expected to propel the market forward.

Growing Demand for Fleet Management Solutions

The Integrated Vehicle Health Management Market is benefiting from the growing demand for fleet management solutions. Companies are increasingly recognizing the value of integrated health management systems to optimize fleet operations, reduce operational costs, and improve vehicle uptime. The rise in e-commerce and logistics sectors has further accelerated this trend, as businesses seek to enhance their fleet efficiency. According to industry reports, the fleet management market is anticipated to reach USD 30 billion by 2026, which will likely drive the adoption of integrated vehicle health management systems as a critical component of fleet operations.

Integration of Advanced Analytics and Big Data

The Integrated Vehicle Health Management Market is increasingly shaped by the integration of advanced analytics and big data technologies. These tools enable manufacturers and service providers to analyze vast amounts of data generated by vehicles, leading to more informed decision-making regarding maintenance and repairs. By leveraging predictive analytics, companies can identify potential failures before they occur, thereby reducing costs and enhancing vehicle reliability. The market for big data analytics in the automotive sector is projected to grow significantly, indicating a strong correlation between data-driven insights and the adoption of integrated vehicle health management systems.

Consumer Awareness and Demand for Vehicle Longevity

The Integrated Vehicle Health Management Market is also being propelled by rising consumer awareness regarding vehicle longevity and maintenance. As consumers become more informed about the benefits of regular vehicle health assessments, there is a growing demand for integrated solutions that provide comprehensive health monitoring. This trend is particularly evident among environmentally conscious consumers who seek to prolong the life of their vehicles while minimizing their carbon footprint. The increasing availability of user-friendly applications and platforms that facilitate vehicle health management is likely to further stimulate market growth, as consumers prioritize proactive maintenance.

Leave a Comment